You already know that home buying a house in Minnesota is complicated, but if you haven’t been through the process there are many details you need to be aware of. Even if recently you bought a car and felt like you were on your game at the dealership, buying a house is definitely like playing in another league.

Here’s what you really need to know:

Everyone Likes to Get Paid

Home deals regularly generate multi-hundred thousand-dollar deals, and lots of people want a piece of that. Lawyers, Realtors, title companies, surveyors, paralegals and even more groups are all in the hunt for your money, so let’s look at some of the costs.

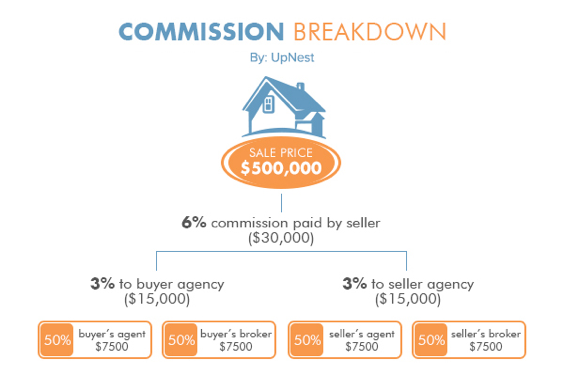

Realtor Commission

Standard real estate commissions are six percent of the total deal with the amount split between Realtors or real estate agents involved. Even though this amount is almost always paid for by the seller, you can bet that it has been rolled into your purchase price.

Title Policy

When you buy a property, you must be sure that you are not purchasing someone else’s problems. Title companies insure that you will have a clean title; if something comes up later—like a lien the title company did not uncover—the title company will have to make things right at their expense. This can cost you $1500 to $2000, however.

Document Preparation

Lending institutions love to charge for you document prep, even if they are only cutting and pasting into a form document. This can set you back $500 or more.

Attorney Review

The same goes for the cost of having the bank’s lawyer review the deal. This can cost $150 – $500. And if you need more information about real estate law, check out this real estate law resource.

Underwriting Fees and Application Fees

Lenders also may charge you random amounts for merely applying for your loan. The due diligence they normally perform is often charged as an underwriting fee.

Fee For Buying A House in Minnesota

So, you go to the bank, they approve your loan and they give you an interest rate. You’re done, right? Not so fast, because the bank many times will charge a fee to lock in your interest rate for a fixed time period. Don’t forget to include this fee in your budget!

Origination Fee

This is free money for the bank. They may charge one percent of your total loan just to give you the privilege of borrowing money! If you need a more clear definition of the origination fee, you can take a look at this resource from Investopedia.

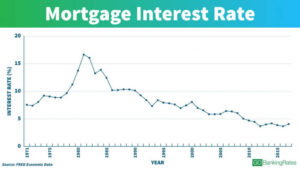

Discount Fee

If you want a lower interest rate when you’re buying your house in Minnesota, you can pay upfront. This is sort of like the $199 per month car payment that requires $3,000 at signing. And when it comes to your interest rate, take a look at a few of the major factors that determine the actual rate.

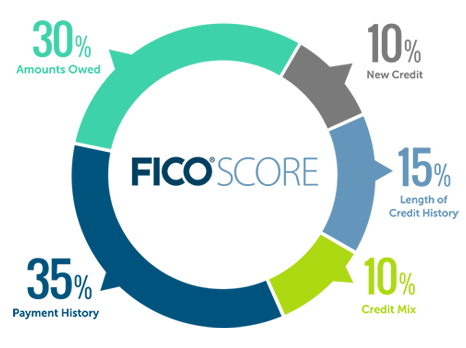

Credit Report Fee

The bank can access your credit report for free—so can you at Credit Karma—but they might charge you 35 bucks anyway. Remember, pay your bills on time, take out smart loans for other purchases and make sure you keep track of changes to your credit score. It’s a very important piece of the home buying process.

Appraisal

You know that you are buying a house in Minnesota at market rates, but your bank wants to be sure, so they will send a $500 appraiser out to confirm that the sales price meets the neighborhood comps—of course at your expense. For more information about what an actual appraisal means, check out this real estate appraisal resource from Wikipedia.

But Wait

That’s not all as the bank may even charge you a wire fee to send your loan proceeds to the seller. Creative financial institutions are constantly looking for more ways to add costs to your home buying transaction, and you may be even charged a signing fee for executing your loan documents!

Having Trouble?

Remember, traditional financing for buying a house in Minnesota isn’t always the only way to go. We at C4D make home ownership possible through MN contract for deed. If you are having trouble with the bank, have large student loan debt, have MN bad credit, have liens, judgments, or just need an alternative financing solution, be sure to contact us; we’ll do everything we can to make your home ownership dream come true.