Mortgage rates have been what some may call artificially low since the Great Recession that began in 2008.

Check out this chart from Freddie Mac and you’ll see that average mortgage rates —t hat topped out at a breathtaking 18.48 percent in January of 1982 — have been below five percent since early 2010. Since then, these low rates have meant a huge increase in buying power for those seeking homes.

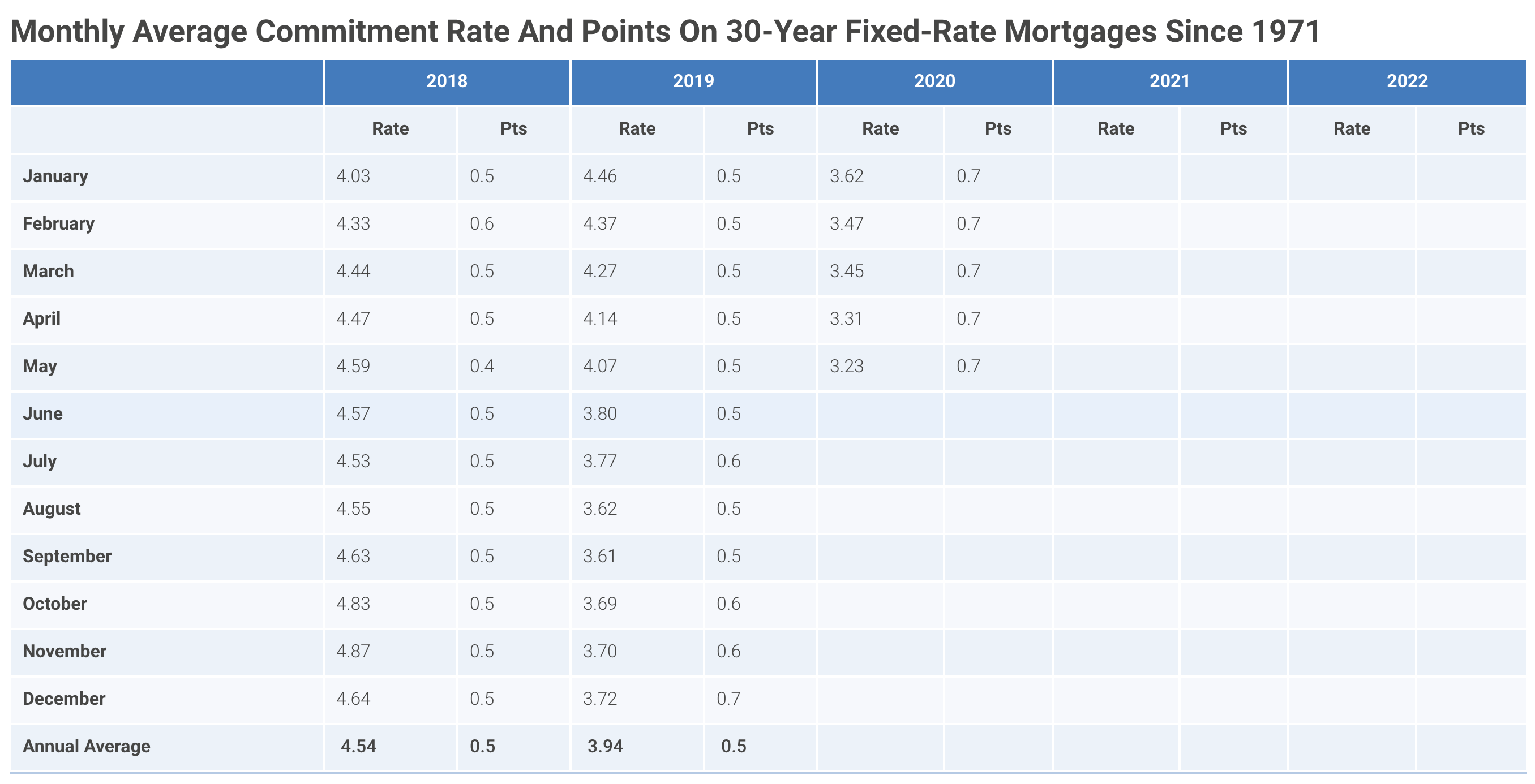

You’ll see some more recent information in the image below.

image via themortgagereport.com

For example, a $350,000 loan at five percent would cost $1,879 per month (principal and interest), while that same loan at four percent would cost $208 dollars less per month. That’s more than a 10 percent payment decrease.

Coronavirus Effects on Mortgage Rates

The pandemic caused an unprecedented near-total forced economic shutdown, and the U.S. government responded with a massive dose of liquidity that included individual stimulus checks, expanded unemployment benefits, forgivable Payroll Protection Program loans, and help from the Federal Reserve in the form of lowered interest rates. This caused mortgage rates to fall below three percent in some cases, further extending buying power.

Higher Credit Scores Needed

While three percent interest rates are a great incentive to home buyers, these coronavirus mortgage rates can be more difficult to attain since many lenders quickly pivoted to recession-mode and subsequently raised minimum credit score requirements.

Bankrate.com tells us:

“Wells Fargo and US Bank both adjusted their minimum score requirement to 680 (including for FHA and VA loans, which typically feature lower credit-score requirements as low as 580), while Flagstar Bank upped its minimum to 640.”

While buyers can carefully check their credit reports for errors and correct them in order to boost their scores, this fix will not work for those that have legitimate credit issues, and therefore many buyers may be unable to avail themselves of these historically low rates.

Consider a 15-Year Term

Well-qualified buyers can get an amazing 2.87 percent rate for a 15-year mortgage. 15-year coronavirus mortgage rates will mean a higher monthly mortgage payment initially, but the entire loan would be retired in 15 years.

If buyers can qualify for and afford a 15-year mortgage, it’s definitely an option to seriously consider. It might also be something to consider, if you’re thinking about selling a house after 1 year.

Refinancing an Existing Loan

Those that bought homes with loans with pre-coronavirus mortgage rates of four percent or more might consider refinancing their current loans. A person with a $350,000 mortgage currently at four percent can save a not insignificant $195 per month if a three percent rate can be secured.

Even if there are some refinancing closing costs included, these can be overcome in a few years by factoring that almost $200 per month in savings.

Forbearance for Coronavirus Mortgage Rates

The Consumer Financial Protection Bureau succinctly explains options that are available to homeowners that cannot make mortgage payments due to the pandemic:

“If you experience financial hardship due to the coronavirus pandemic, you have a right to request a forbearance for up to 180 days. You also have the right to request an extension for up to another 180 days. You must contact your loan servicer to request this forbearance. There will be no additional fees, penalties or additional interest (beyond scheduled amounts) added to your account. You do not need to submit additional documentation to qualify other than your claim to have a pandemic-related financial hardship.”

If you are having trouble making payments, you do have to take the first step and contact your loan servicer as mortgage forbearance is not automatic, so make sure that you proactively do this before you make a late payment.

Tighter Mortgage Lending Criteria

As we had mentioned previously, banks have tightened mortgage lending standards. For those with less than perfect credit, this can now be a problem. In good times, a credit blip or issue can sometimes be ignored, but in perilous times like these, one late payment can derail an otherwise solid mortgage loan application.

If you did everything possible to nudge your credit score to 650 and now you find that the low coronavirus mortgage rates are still out of reach, you might want to consider some non-traditional financing options like contract for deed.

An MN contract for deed deal allows a third-party company like C4D, for example, to purchase a home from the seller and lease it back to you. When you have made all of the monthly payments, or if you are able to get conventional financing before the contract officially ends, the deed is given to you.

The stock market certainly seems to think that coronavirus troubles are behind us, and if true, mortgage interest rates could rise in the near to medium term. Therefore, if you can lock in one of these low rates now, you may be participating in a once in a lifetime financial opportunity.