Buying a home sometimes seems impossible. For starters, how do you come up with money for a down payment? Should you get first time home buyer down payment assistance? And what does that even mean? Well, let’s get into the details.

If you don’t own your own home now, let’s say you’re leasing an expensive place in the ever-popular Austin, Texas, then you’re probably paying rent to someone. In many cases, that rent payment would probably be the same as a home mortgage payment; the only problem is, you usually need a down payment in order to qualify for a mortgage. Some reasons for this are:

- It protects the lender. If you default, at least they have received some cash.

- It shows you will be motivated to pay the mortgage because you have skin in the game.

- It shows that you can save money while at the same time paying your bills.

Even if you are buying a home using an FHA mortgage, you’ll still have to come up with at least three percent of the purchase price, and with a $350,000 home, this can still be over $10,000. So how do you go from zero to $10,000 relatively quickly? What first time homebuyer down payment assistance is available?

First Time Home Buyer Down Payment Assistance Gifts

It is completely legal for someone to gift you your down payment assistance for first time home buyers, and the way tax laws work, relatives can give you up to $15,000 tax free. They could also give that amount to your spouse, so taxes are not an issue. If you do use gift money for a down payment, the lender is going to want to track it, so make sure that this transaction is completely transparent.

Consistently Save and Start Early

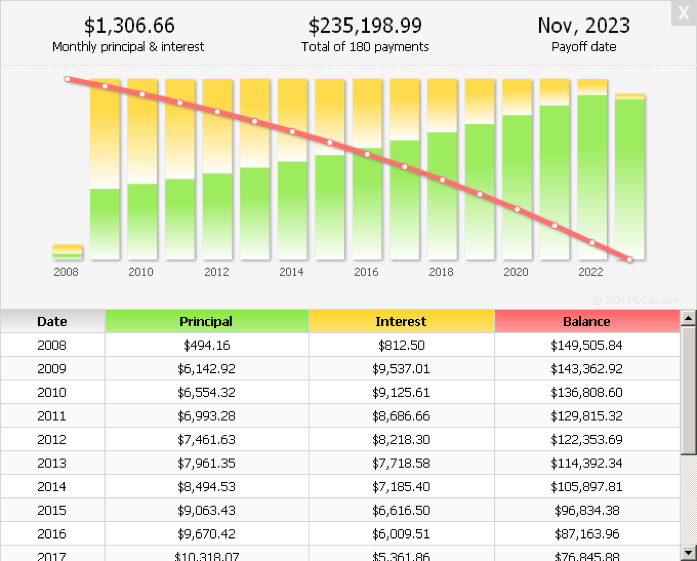

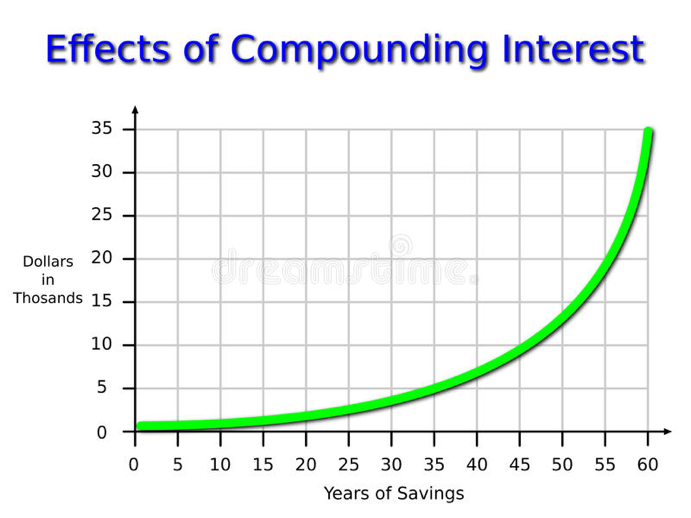

Just as interest compounds on credit cards and student loans (advice here if you need help with those overbearing student loans), the magic of compounding works the other way also. Save $100 per month at an average rate of four percent, and you will have $14,983.62 at the end of ten years. So, if you start saving when you are 16 years old, you’ll have a nice down payment at age 26 and you won’t be looking for first time homebuyer down payment assistance.

There are also many sites out there, much like our friends at the Saving Expert, that will help you get your finances on track. And don’t forget about that side hustle; online jobs can be a huge help!

Loans

Check out what the State of Minnesota has to say about first time homebuyer down payment assistance:

“When you get a Minnesota Housing mortgage, you can also receive an optional down payment and closing cost loan up to $15,000. Down payment and closing cost loans are only available when you get a Minnesota Housing first mortgage loan and additional eligibility requirements may apply, including income limits.”

Other states have similar programs also.

Tap Your IRA

If you have a substantial IRA, it may be worth it to withdraw funds. Our friends at nerdwallet.com tell us:

“IRA withdrawals for home purchases are allowed, up to $10,000. Roth withdrawals are tax-free and without penalty if you’ve had the account for at least five years. Tapping a traditional IRA will trigger income taxes.”

Crowdfund It

Have a good story? Set up a Kickstarter or GoFundMe site and see if you can reach your goal. Again, the lender will of course want to track your down payment dollars, so make sure everything is easily documentable.

Down payments may seem daunting, but with planning and diligence, you should be able to raise the funds to get you on the path toward home ownership.