Bankruptcy used to be considered the financial death penalty, but times have changed. While many people worry about life after bankruptcy, the future after filing Chapter 7 is not necessarily bleak.

Bankruptcy – What Is It?

Bankruptcy – What Is It?

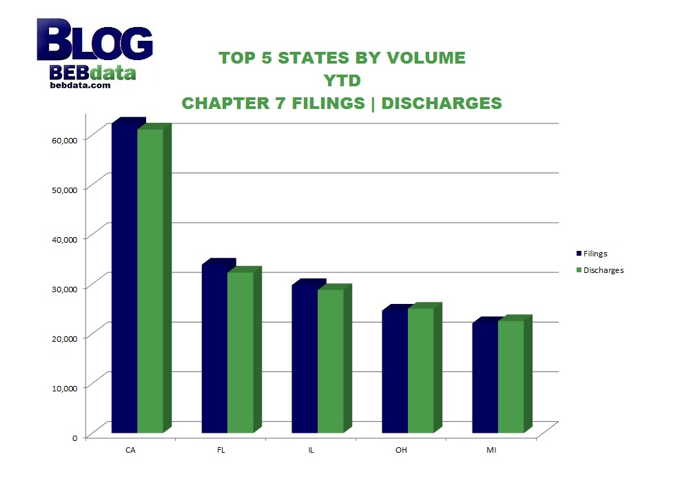

There are two types of commonly filed individual bankruptcies—Chapter 7 and Chapter 13. Chapter 7 is a liquidation process where certain assets are given to a trustee that sells them in order to pay off creditors.

Chapter 13 was designed for those that wish to pay their debts but need time. A person that files for Chapter 13 bankruptcy works out a plan to make monthly payments to a trustee; the trustee then makes payments to creditors for a three or five-year period. After that time has passes and all payments have been made, certain remaining debt amounts may be cancelled.

Credit Score After Chapter 7

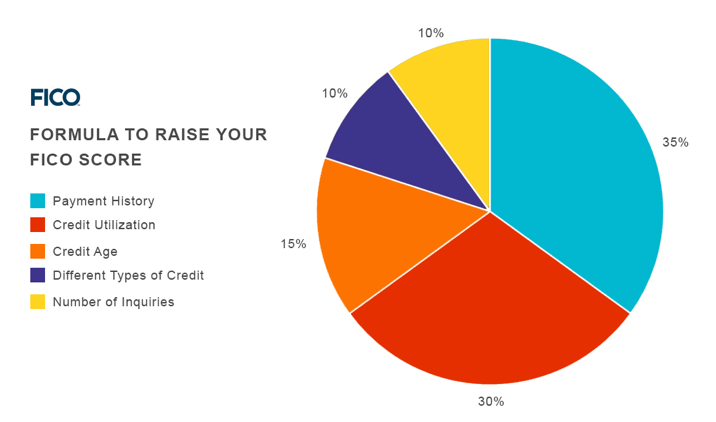

The better your credit score is, the more your credit score will decline. Credit scores average around 540 after bankruptcy, so if yours was 750, it will fall a lot further than if it was at 640 before bankruptcy. The good news is that many debts will be discharged—taxes, student loans, child support and some others won’t go away—and you will be able to start fresh. If you are still employed, or if you get a new job, your monthly expenses will be less, and you may even be able to start saving money, especially if you’re bringing in some money through passive income ideas.

Get a Secured Credit Card

If you declare Chapter 7, all of your credit cards may be cancelled regardless of their balances. Soon after your bankruptcy has been discharged, however, you will receive secured credit card offers. Put $500 in a secured account, and you will be rewarded with $500 of fresh credit.

*Note: although it might not be a ton of money, you can also check out using some apps that pay. You never know what a few extra dollars can do for a bank account each month.

You Still Have a Debit Card

Even if you have to open a new bank account, you can get a debit card. You can use it virtually anywhere you can use a credit card, so if you need to buy a plane ticket, you will be able to. Before debit cards became popular, people did have issues paying for items that required a card number, but that’s no longer the case.

You Can Even Get a Car

If you have file for Chapter 7 bankruptcy you cannot file again for eight years. Since you can’t file, you are actually somewhat of a better credit risk, and as time passes you will actually be able to borrow normally for items like appliances and autos.

Think Cosigner

If you have immediate financial needs and you have to borrow, try to get a cosigner. That person will be absolutely responsible for your debt, but if you make all of the payments on time, there will be no harm to the cosigner.

Life After Bankruptcy: Go Back to School

If you haven’t availed yourself of the Federal Student Loan program, you can go to a post-secondary institution for a bachelor or master’s degree or you could even go to law school or enter a PhD program. Federal student loans are available for all citizens—unless you are a drug offender—and there is no credit check required. If you take six credits at a major university, you can have all of your tuition paid and even receive some extra money you can use for expenses.

Yes, there is life after bankruptcy. Borrowing for a home will be more difficult, but the financing pros at C4D can help with these types of issues. Be sure to contact us for more information.