Becoming new homeowners can mean a blur of expenses, but it’s really important to think about what you are spending money on so that you don’t make wasteful decisions, especially if you need money now.

Here are seven things to consider:

Ditch the Lawn Service

New homeowners may think that they don’t have time for yard maintenance, but you can be assured that lawn services don’t do anything different that you could do. The same fertilizers they use are available at garden centers, and services like aeration are just not absolutely necessary. Garden centers will also give you free advice and will walk you through any lawn issues you have. Furthermore, they have the most professional equipment, like riding lawn tractor, it’s very expensive if you buy yourself.

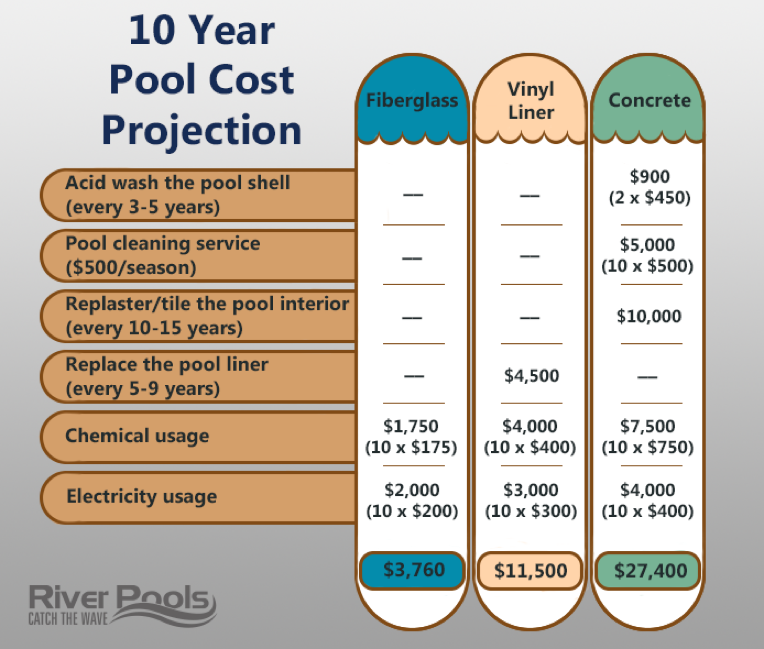

Forget About the Pool

If you buy a home with a pool, you have bought a place with lots of monthly maintenance needs. Every time the pool guy comes out, you will incur costs for cleaning, maintenance and pool chemicals. To be safe, your pool has to be regularly tested for proper chlorine levels, and don’t forget about the cost of water that can be very significant in dry southwestern states. While robotic pool cleaners are worth the money long term, the initial price range can set people off, so be sure to do your research first!

No Sun Room

Thinking of adding a sun room? Well think again, because even though new homeowners may hope to recoup their original sunroom investment, studies have shown that unlike kitchens or bathrooms, the addition of a sunroom very rarely even comes close to paying for itself.

Back Up Generator

ENERGY GENERATION BY SOURCE

A good one can cost thousands of dollars if you live in a non-hurricane prone area, so just trust the grid. And if you’re worried about losing a lot of frozen food, many freezers and homeowners’ insurance policies already protect against this occurrence.

Private Mortgage Insurance

If you don’t have 25 percent equity in your home, you may need to buy Private Mortgage Insurance or PMI. This can easily cost new homeowners up to $200 per month or more in premiums, and new homeowners never recoup this cost. If there is some way you can find a 25 percent down payment, by all means put that bigger amount down to avoid paying PMI. If you have been in your home for a while, a hot market may have increased your property’s value, and you can apply to have your PMI removed. Check with your lender about this.

Cheap Windows for New Homeowners

If you need new windows, don’t but cheap ones, because your HVAC costs will just increase. Spend more for a better product and your investment will pay off immediately.

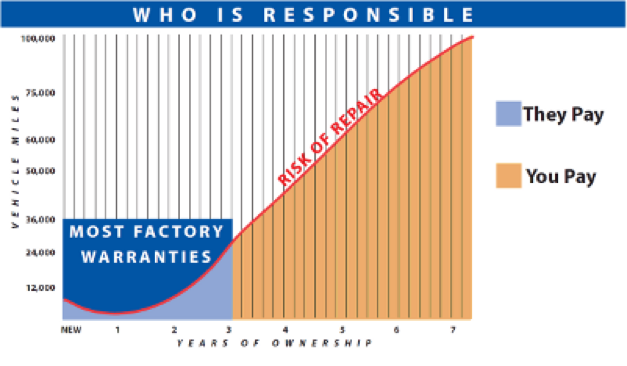

New Homeowners & Extended Warranties

According to our friends at BeerMoney, “Retailers are not going to sell anything that doesn’t make them money, and when they sell you an extended warranty they are getting extra revenue from you. For example, you purchase a $32 string trimmer.” The extended warranty is $8.00 per year. Sounds good, but after four years, you have doubled the cost of your garden tool. We suggest not paying anything extra, and just buying a new $32 trimmer when and if it breaks.

Also, there may be a convoluted and difficult repair process that could cause you to be trimmer-less for a period of time if you go the warranty route.

We’re really happy you are in your new home. Now, just be sure to carefully consider all of your home-related purchases so you don’t waste precious cash. And don’t forget, if you need to grab a few extra dollars, you can always sell things you currently own, such as totaled cars, old technology and other stuff laying around at home.

Good luck!