Sometimes things get really difficult, and you think you’ll NEVER be able to repair your credit.

You may have lost your job, faced massive medical expenses, your business failed, or maybe you just bought a more expensive house than you could handle. While you tried to avoid foreclosure, you woke up one day and realized that it was inevitable.

If you lived in a non-judicial foreclosure state like Minnesota, the process probably happened quicker than it would have had you lived in neighboring Wisconsin where foreclosures sometimes slowly wind their way through the court system. Nevertheless, it’s over now, and you’re afraid to look at your credit score. Times might be tough, but you NEED to understand how to repair your credit.

The Foreclosure Effect

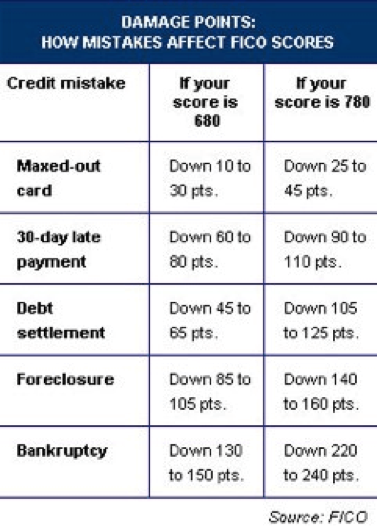

The bad news is that your credit score can drop as much as 150 points or more once the foreclosure process is completed, but the good news is that while a foreclosure will stay on your credit report for up to seven years, you can watch your credit score rise if you do the following:

Repair Your Credit By Considering Bankruptcy

If foreclosure is merely one symptom of your financial distress, and if you still have lots of debt that you are unable to pay, consider wiping the slate clean with a Chapter 7 bankruptcy. If your credit score is going to take the foreclosure hit, it may be prudent to clear as much debt as possible through bankruptcy and truly start fresh.

Remember, however, that certain debts like student loans and taxes are not normally dischargeable in bankruptcy.

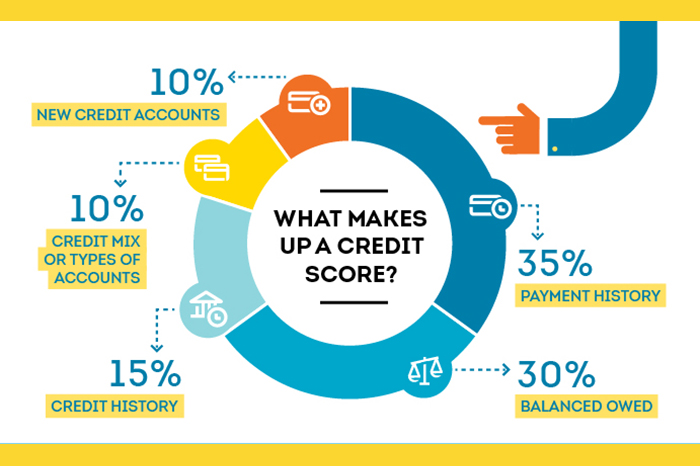

Don’t Be Late

Late payments will only set you back again, so make all payments on time. Do a thorough budget analysis and do everything possible to pay all bills when they are due. This may mean getting a second job or going out to eat less often but do whatever it takes to never be late with a payment again.

Rebuild and Repair Your Credit Score

Credit can be rebuilt; it may be challenge, but it can be done. Newly bankrupt individuals often quickly receive high interest and high monthly fee credit card offers. Some of these are almost predatory as you may be offered a $300 line of credit minus a one-time fee of $75. Still, if you make on-time payments, even these companies will report favorably to the credit bureaus.

Friends and Family Can Help

If you need money, see if you can borrow it from friends and family. They don’t report to credit bureaus, and they may offer you very generous repayment terms.

Go Back to School

Federal student loans are provided without checking your credit score. Didn’t hear us the first time? You can get a federal student loan with bad credit that includes bankruptcy and/or foreclosure. There are caveats of course — and you still want to work hard to repair your credit score. If you have defaulted federal student loans, or if your bankruptcy is active, you may have issues.

If your only problem is bad credit, late payments and even a foreclosure in progress, you can still get a loan. At a good state non-profit university, you can take six credits—some of them online—get a federal student loan, have the loan pay your tuition, and there still can be money left over for you to live on. Yes, you have to pay back student loans, but not until you are finished with school.

Buying a Home After Foreclosure

Banks want squeaky-clean credit and no missed payments of any kind for 36 months before they will even consider you for a home mortgage. We know it’s tough to go for three years without a financial blip, but this is where the experts at C4D can help, while you work to repair your credit score.

We use MN contract for deed to get you into a home that you will own free and clear after you make all of your payments. Because we look at people—not only credit reports—and because we have developed superior banking relationships over the years, we can help you buy a home after a financial crisis. Bankruptcy and foreclosure should not be considered financial death. You will have been injured, but you can recover. Check out our site to see how we can help you like we have helped countless others.