You’ve saved some down payment dollars, you’ve checked your credit and made sure that there are no inaccuracies on your credit report, and you really want to take the next and become a homeowner. You’ve searched endlessly about how to afford a house.

Your question now is, “How do I figure out the price range of houses I should be considering? What can I really, truly afford?”

The answer is logical and can easily be calculated.

Debt to Income Ratio – What Does It Mean?

Lenders need to know that you will be able to make your housing payment. Since your mortgage will be the most important payment you make, you might think that it is out of the question to even consider being late or missing a payment, but because foreclosure takes some time, more homeowners than you think will stop making their housing payments when they get into trouble.

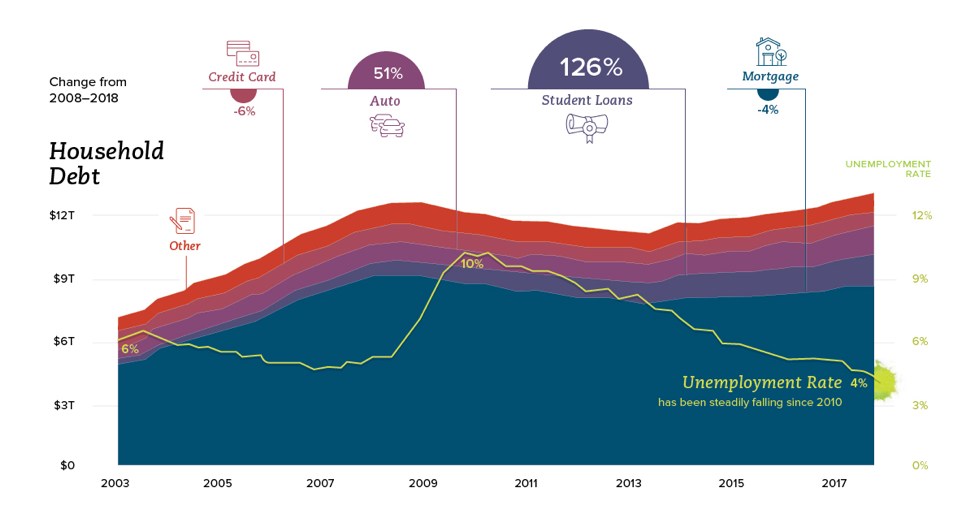

In fact, during the financial meltdown that occurred beginning in 2008, lenders were surprised at the number of what they thought were quality mortgagees that suddenly just stopped making their payments.

Lenders have historically used the debt to income ratio to qualify applicants, but since 2008, this number has become more formal, and conventional lenders have less leeway than they might have had before that time.

Depending upon the loan program and lender you choose, your debt to income ratio will need to be no more than 36 to 43 percent of your income.

Therefore, if you make $10,000 per month, you mortgage payment including taxes and insurance should not be more than $3600 to $4300. Before the financial crisis, some sub-prime lenders ignored the debt-to-income ratio altogether, would accept ratios higher than 50 percent, would ignore some debt sources like student loans, or would take the word of an applicant regarding their total income without proof.

All of these things led to disaster.

How to Afford a House with Down Payment Assistance

Your down payment reduces your monthly payment because your mortgage loan will be less, so first accumulate all of the down payment dollars that you can, if you’re wondering about how to afford a house. Some states offer down payment help, and many lenders will allow you to receive a gift for part or all of your down payment. If you are buying a $200,000 home, and you have a $20,000 down payment, you know that the mortgage loan you are looking for will be $180,000.

Mortgage Calculator

Next, use a mortgage calculator to see what your monthly payment would be. The good calculators will allow you to add monthly property tax and insurance payments to this total. Let’s look at a $180,000 30-year mortgage. We’ll use five percent as the rate and the principal and interest you would owe monthly would be approximately $966.00. Add a $150 property insurance premium and $250 per month for property taxes and your payment would be $1366.00 per month.

Please note that property tax rates and insurance costs vary widely, and these figures are for example only. If we multiply $1366 by three that would give us the amount of income you would need to support a comfortable debt-to income ratio of 33 percent, and that amount would be $4098.

Sources tell us that lenders usually look at gross income, so to afford your $200,000 home after you have made a $20,000 down payment you would need a monthly income of a $4098 or close to $50,000 per year.

What About Differences?

Higher interest rates will off course cut your home buying power. Mortgage principal and interest for a $180,000 loan at five percent jumps $230 per month at seven percent but would drop $210 at three percent, so be aware of interest rate changes.

Closing Costs, Too?

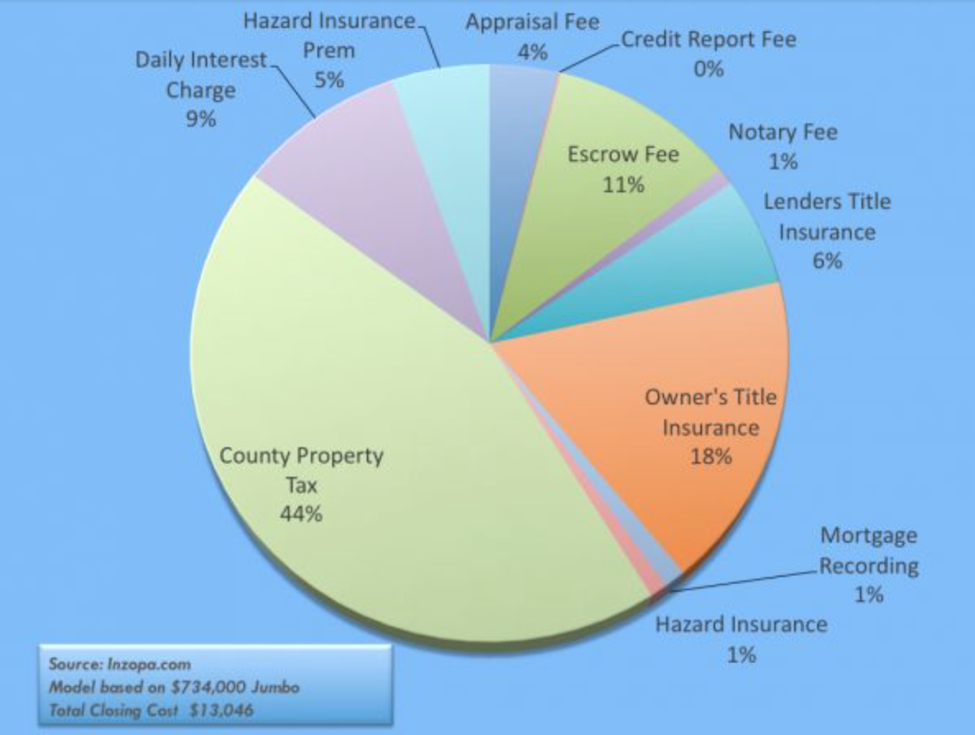

One thing to watch out for is closing costs that can equal four or more percent of your total loan. Therefore, if your loan amount is $180,000, your closing costs could be $7200 or more, and you need to include these in your home purchasing budget. Your Realtor can help you try to get the seller to cover some of these costs, however.

How to Afford a House with Pre-Approval

While the process of figuring out exactly how much home you can afford may look like a lot of work, if you go to a bank or lending institution and ask to get pre-approved for a mortgage, they will do that work for you. The pre-approval process requires verification of your income and debts, but this will have to be done anyway sometime during the mortgage loan process. A lender will know exactly what to ask you for, and after they have received your information, the lender can advise you of the mortgage amount you are pre-qualified for. Also, when you are in receipt of a pre-qualification letter, you will be better presented to sellers as a serious buyer.

Types of Loans

Remember to consider the various mortgage types available. 15-year loan terms mean that if you make all of your payments in 15 years you will pay off your mortgage in half the time it would take you to retire a 30-year loan. The monthly payments will be higher, but the savings over the loan term with a 15-year v. a 30-year loan can be staggering.

Alternatives

Remember, while conventional financing is preferable, there are circumstances where it just may not work for you. If you have recently declared bankruptcy, had a foreclosure, are behind on credit card bills or student loans, your ability to obtain a convention mortgage loan may be hindered.

If that’s the case, be sure to check out programs like contract for deed as these home buying options can definitely be a great alternative to conventional mortgage financing.