It’s great that you have some extra cash to invest, and it’s come to down to investing in real estate vs. stocks. So, how do you know what to do?

You like the quick pops you can get from equities, but lately you’ve been worried about volatility and the effect of lower interest rates on the market. You’ve also been looking at some supposedly undervalued companies, but you’re also concerned about a value-trap situation like GE or even Bank of America.

If you ask us, we’d take real estate as an investment any day over stocks, and following are seven great reasons why:

It’s Tangible

When you buy a stock, maybe even using Stock Apps, you are purchasing a piece of a company. The only problem is that you will have no say in the company’s day-today operations. You’re an owner, but virtually a silent one.

Sure, you can team up with other shareholders and vote at a shareholder’s meeting, but you will be one of millions of stockholders, and your lone vote won’t have a significant effect on the way the company does its business. The Green Bay Packers are publicly owned, but most shareholders have no voting rights, so while you are a company stockholder you can’t call the coach and tell him to call different plays.

Well, you could call him if you had his number, but our point is that you have no real power just because you are a shareholder of the Green Bay Packers or a large public company. You’re basically along for the ride.

You can always buy shares of stock, perhaps you are someone who wants to buy palantir shares, but if you buy a piece of real estate, especially a first time buyer, you can see it, touch it and manage it if you want to. You can drive past every day and make sure that it’ still in good condition. It’s there and it’s a tangible item. And, you can make decisions about repairs, rentals, upgrades and marketing. If you decide that investing in real estate vs. stocks is the way to go for you, you’ll be in control.

You Make the Decision Based Upon What You Actually See

When you buy a stock, you can see the prospectus, read reviews online and then basically take a chance.

If you’re a Peter Lynch guy, you’ll buy shares of Kohl’s Department Store, for example, if you’ve had a great shopping experience there. What goes on in the boardroom, however, will be hidden from you, and you may be the last to know when surprises are about to rile the market.

When buying real estate, you can actually “kick the tires.” (That’s what your dad did before he would buy a car. People used to think that if the tires were sound a used car was a good buy.) Anyway, you can certainly ascertain if a property needs work, and most people get a professional inspector to help them unmask potential problems before purchasing real estate.

Less Volatile

Ok, if your city decides to put a sex offender residence facility next to your property, you may see a quick downward price trend, but those who like investing in real estate vs. stocks will usually not experience quick property value declines. Even in severe recessions, housing price decreases usually take some time to materialize, and you should have time to get out before a housing crash manifests itself.

Less Fraud

If you like penny stocks you can get burned in a hurry. If you like unicorns and startups, the same thing can happen. If you like futures, just beware. There are lots of scammers out there and “pump and dump” schemes are a cloud that often hangs over certain stock market areas.

When you buy property, however, you won’t enter into a transaction until you receive a fresh title policy form a reputable insurance company, and few banks are going to give you a mortgage on a apiece of property with a clouded or even minimally questionable title status. With a little diligence, you’ll be sure that the seller of your property actually does own it.

Inflation Hedge

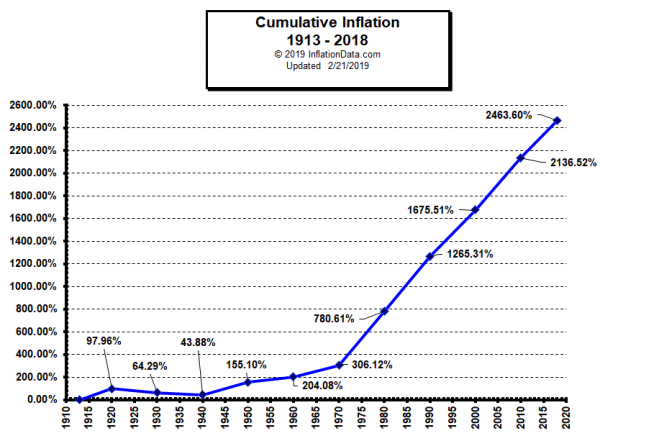

When some ponder investing in real estate vs. stocks, they point to inflation as an overriding decision-driving factor. Investopedia.com says:

“For the majority of U.S. history – or at least as far back as reliable information goes – housing prices have increased only slightly more than the level of inflation in the economy.”

Only during the period between 1990 and 2006, known as the Great Moderation, did housing returns rival those of the stock market.

The stock market has consistently produced more booms and busts than the housing market, but it has also had better overall returns as well.”

While we understand the statistical relevance here, we are in a unique environment with a top-heavy stock market and record low interest rates and we’d feel much more comfortable with an income-producing four family than with 200 shares of Samsung stock.

There is a lot of geo-political tension, and we feel real estate is in a better position than stocks to defend itself against these threats.

Real estate is tangible, solid and slower moving than stocks. Even though stocks may seem easier to sell at time, we like the traditional and concrete value that real estate presents.

And if you’re looking to buy some real estate without much money down, you can always contact us to get started.