For any number of reasons, you may want to invest in real estate. You may have attended a seminar, read a book or have friends and relatives that have made a lot of money—or claimed that they did—by simply and passively investing in real estate. Every investing arena has its own language, and if you really want to consider real estate as a viable investment vehicle, there are some examples of real estate terminology you need to understand, and following is a good list:

Debt Service

This refers to the amount of money is takes to pay—or service–a rental property loan or home loan every month. If the principal and interest of your mortgage note combined are $985 month, then that is the amount it will take to adequately service your loan. If you envision having multiple properties with mortgages on all of them, you need to add the required payments together and the result will be your debt service amount.

Operating Income

Take all of your gross rental income dollars, add them together and you get your operating income. This is a similar term to gross income meaning dollars you put in the bank before you pay expenses.

Net Operating Income

This is the amount of money left after you pay all of your expenses like taxes, insurance, yard maintenance, repairs, rental costs, and of course your debt service. Subtract your expenses from your operating income and that will give you your net operating income.

Short Sale

A short sale occurs when a distressed owner sells a property for less than what is owed to lenders. Lenders of course have to agree to a short sale, but by agreeing to a short sale they can avoid costly foreclosure proceedings that in some states can take years to complete. Short sales can be good investment opportunities if you do your diligence. You have to be patient, though, because sometimes banks just do not respond quickly to short sale offers.

Broker Price Opinion (BPO)

An appraisal is a formal document that carefully explains what a property is worth. If a house appraises at less than what it is being sold for, lenders typically reject the deal. In the short sale and foreclosure markets, however, banks will sometimes settle for a BPO—a more arcane real estate terminology example– that is an opinion of value authored not by a certified appraiser, but by a real estate agent or a Realtor.

Real Estate Owned (REO)

An REO property is one that a lender has foreclosed on and has listed for sale. Since the bank is the owner and may not even have a local branch, you have the chance to get a good deal. The bank does not have the same emotional attachment to the property than a soon-to-be foreclosed owner would, and therefore the lending institution may just want to get the property off of its books. REO properties are not a secret, however, and many that search out foreclosures will be looking at the same property that you are.

Loan to Value (LTV)

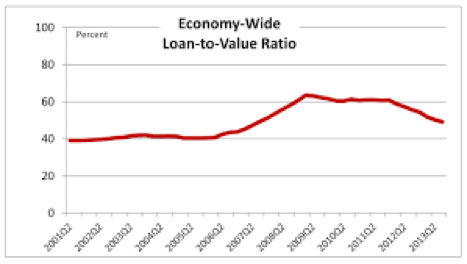

The LTV is the mortgage amount dived by the appraised value of the property. A $100,000 property financed with a $90,000 loan would have a 90 percent LTV. The other $10,000 would be your down payment funds.

While prospective homeowners purchasing their first home can buy a home with no money down—a 100 percent LTV—investors typically need more than that, sometimes up to 25 percent. Also remember that as a precursor to the Great Depression that began in 2008, homes were being financed with a 120 percent LTV.

Amortization Schedule

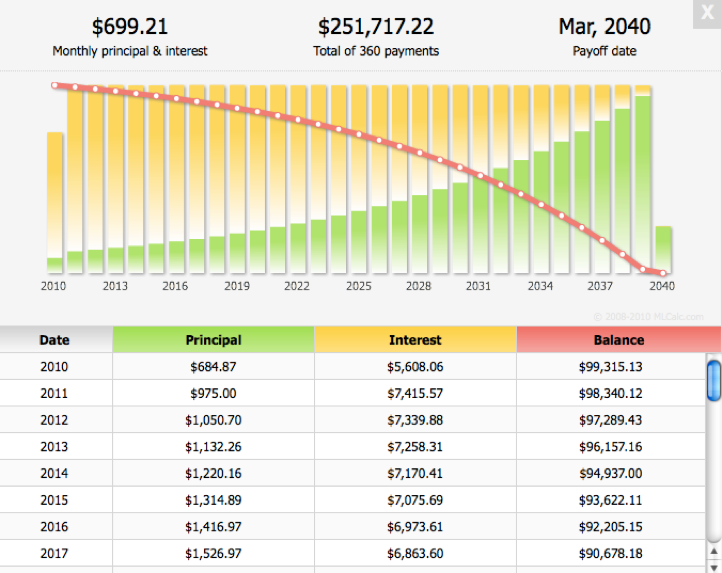

Be sure to go to www.bankrate.com to plug in your proposed loan amount, interest rate and loan term length. Then calculate an amortization schedule that will show you that with a mortgage loan, a large part of your monthly payment goes to interest and less to principal for a period of years before you start paying more principal and less interest. Amortization schedules are part of real estate terminology 101.

Equity

Take the value of your property, subtract everything you owe on it, and that will give you’re your current equity, or the net amount of money the property is worth.

Equity Play

Investing in rental property where the amount of money taken in monthly is not sufficient to cover the monthly costs but where the increase in value can be substantial can be labeled an equity play. In this situation you may lose money on a monthly basis, but you may also get it all back plus a profit when you sell the property.

Traditional Financing

When a property is financed by a bank, perhaps a Playa Vista real estate investment, or mortgage company loan to a buyer that can meet the lender’s stringent credit requirements, that loan, in real estate terminology, is called traditional financing.

Non-traditional Financing

Rent to own or contact for deed deals are two examples of non-traditional financing where home buyers with less than stellar credit can still have a method that leads to true home ownership.

If you are interested in becoming a real estate investor or managing your own property, you absolutely need to understand the terms explained above, but please don’t stop there. Read as much as you can, speak to fellow investors, and attend presentations and meetings to absorb all of the information you can find.