Some positive things have occurred that can make buying a house with student loan debt a little easier:

- Fannie Mae has programs that offer three percent down-payments.

- If your parents pay your loan, it may not be counted in your debt/income ratio.

- The one percent rule–where one percent of your student loans were divided by 12 and counted against your income—has been rescinded.

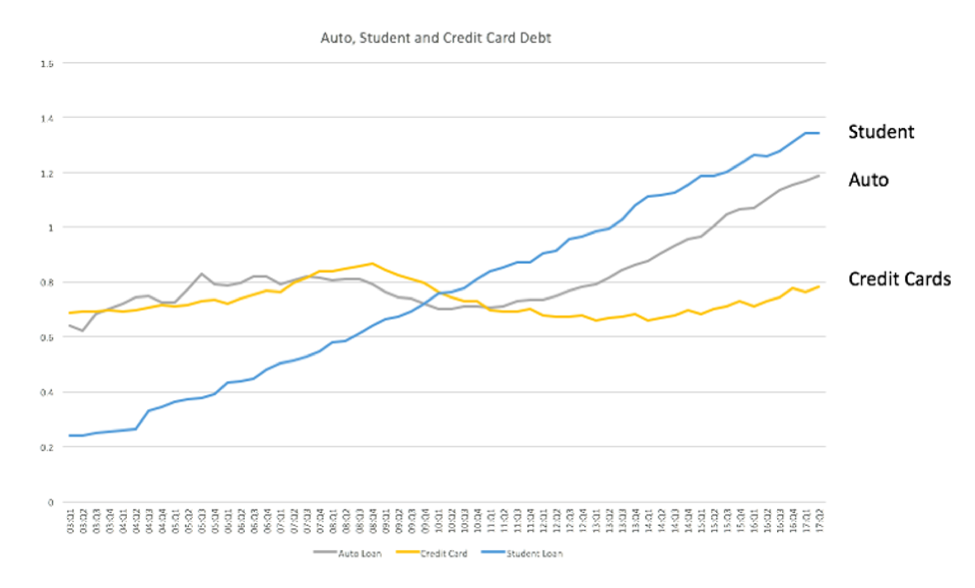

These are great steps, but it still doesn’t solve the problem for people in debt. Student loan debt is at record levels:

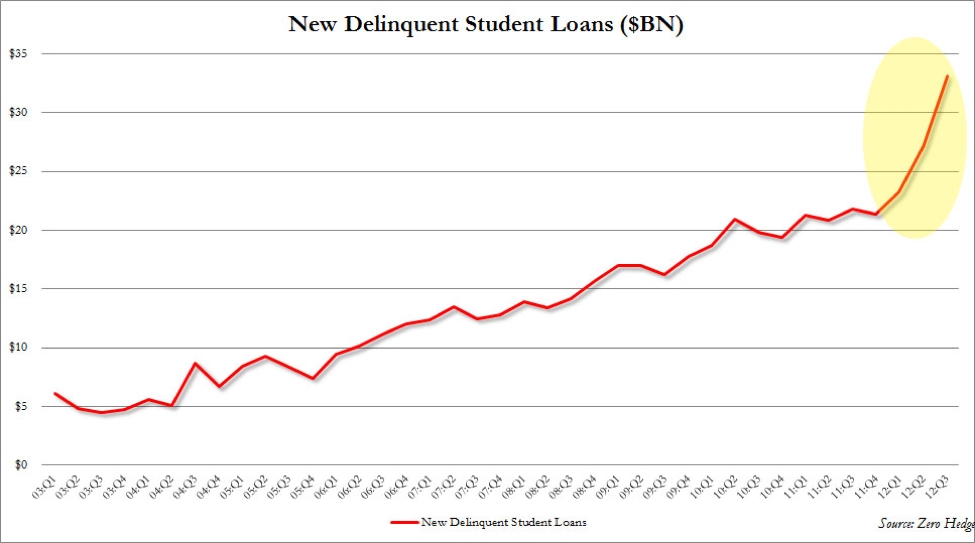

Student loan defaults are even worse:

So even though the government and banks are realizing that massive student loan debt could be the next bubble, there is no easy way out. Because of the 2009 meltdown, lending standards are still stringent, and many student loan debtors just cannot achieve less than the required 43 percent debt-to-income ratio. As Dan Rafter has reported, “While student-loan debt does affect the mortgage-lending process, it boils down to three factors: income, savings and credit; your mortgage professional will look at those three variables to determine what loan you qualify for, if any.”

What To Do Now?

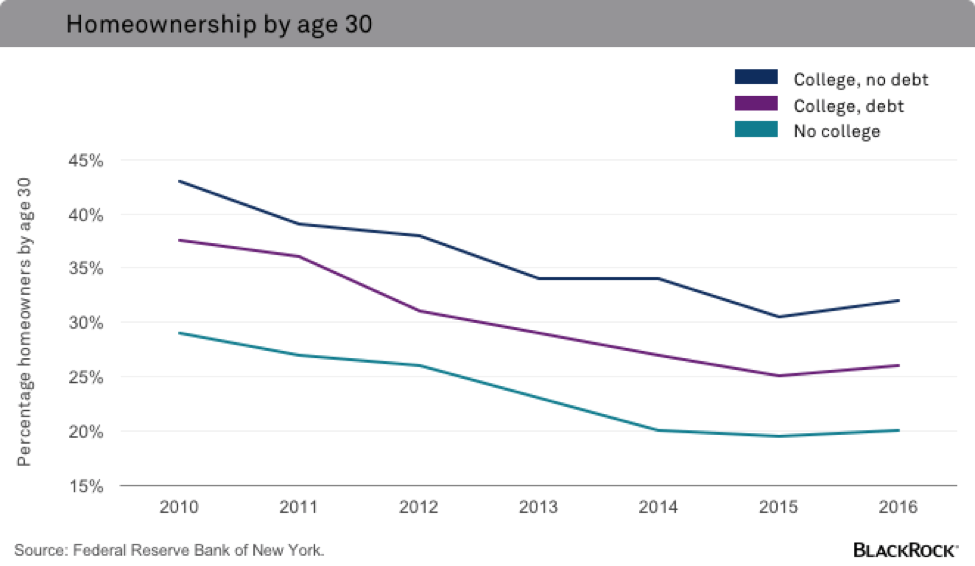

Besides learning how to make money online fast, what else can you do? A graduating law student can easily amass over $200,000 in accumulated student loan debt. A graduating physician can have even more, and these large obligations can wreak debt-to-income ratio havoc. Many pundits actually believe that today’s student loan debtors will continue to have great difficulty qualifying for mortgages, and this will lead to lower housing prices since the demand will not exist. Look at these telling stats:

What Are The Alternatives?

The trends are clear: students have ever-increasing debt loads and even though banks may now be a bit more lenient, traditional mortgage financing may not be possible as iffy credit is often seen as bad credit by lenders. If you have large student loan obligations and are ready to buy a home, but can’t qualify for conventional financing, a MN contract for deed may be the answer.

Contract for Deed – What’s That?

Rocket Lawyer tells us:

“Under a Contract for Deed, the buyer makes regular payments to the seller until the amount owed is paid in full or the buyer finds another means to pay off the balance. The seller retains legal title to the property until the balance is paid; the buyer gets legal title to the property once the final payment is made. If the buyer defaults on the payments, the seller can repossess the property. In some states, a seller who repossesses a property must reimburse the buyer for the fair value of improvements to the house, as well as a reasonable amount for rent.

Contracts for deeds are valid options, and even the primary option for seller financing in most states. The process typically starts as a negotiation between the buyer and seller. Generally, stock and boilerplate terms cannot apply. The average length of a Contract for Deed is five years, but it can be for any amount of time that the buyer and seller agree on. Interest rates on a Contract for Deed are not regulated, so they can be as high or as low as the buyer and seller can agree on. Similarly, the payments can be structured in any fashion that is agreeable to both parties. In some cases, the value of the house may be divided into equal payments so that the full balance is paid off by the end of the term. In others, regular payments are set up with the balance coming due in a balloon payment at the end of the term. Typically, these contracts can be renegotiated so long as both parties are willing.”

How Do I Get Contract for Deed Financing in Minnesota?

- Find homes that are for sale by owner.

- Locate a real estate professional to help you find contract for deed deals.

- Find homes where sellers offer financing.

- Work with a company that makes contract for deed deals happen for those with bad credit.

As you search online, you’ll find that contract for deed (C4D) is accepted and embraced more times in Minnesota than in almost any other state. In fact, C4D financing is many times the preferred method of Minnesota bad credit financing.

You will also discover many articles that warn about contract for deed issues, problems, and consequences. As with any form of home financing, it’s important to have your legal and financial team ready to review all financing proposals that are presented to you. You might also consider working with reputable companies like C4D that make it their business to provide solid, transparent and win-win loan alternatives—even if you are loaded with student debt.