Contract for deed is a popular alternative home financing method that is recognized by most states. Contract for Deed homes can be found in a number of different ways, but it’s important to use professional help when seeking this type of financing for your home, because scams happen and create terrible financial situations for a buyer.

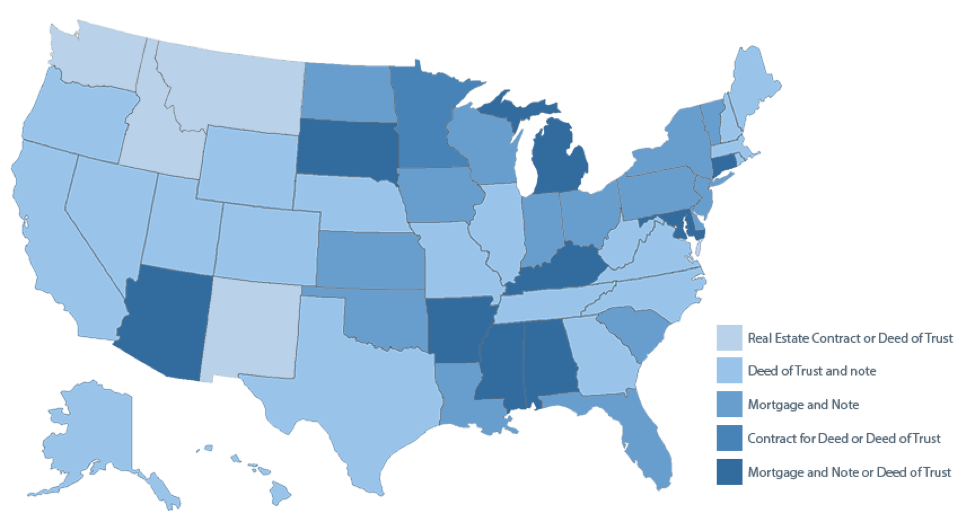

What Is Recognized Where?

When used correctly, it can mean eventual home-ownership for many persons that, for various reasons, like bad credit, cannot qualify for traditional mortgage loans. Unfortunately, some financial advisors do not recommend contract for deed in Minnesota because of various scams and schemes that employ the financing tool to defraud unwary consumers.

What Can Go Wrong

Steve had owned a business for years, but the 2009 recession hit him hard, and his business closed. Steve was personally left with significant debts, tax liens, and open judgments. He also lost his home to foreclosure, and was only able to rent a place to live with the aid of a co-signer. After a few years, Steve was able to regain his financial footing and wanted to purchase a home but his damaged credit prevented him from getting a traditional mortgage.

One day he stumbled upon a listing for a nice home in a great area that was offered for sale by owner. Steve and the owner came to a quick agreement upon price, and the seller offered Steve a contract for deed. The deal looked like this:

- Purchase price – $200,000

- Down payment – $10,000

- $190,000 financed for 30 years at 6.5 percent.

Even though the interest rate was a little high, Steve liked the deal. The seller explained that while the deed would remain with him, he would transfer it to Steve after all payments were made. Steve also had the right to prepay with no penalty.

The seller offered to have his attorney do the paperwork, and since Steve considered himself legally savvy, he read every line of every document and then signed the deal. Things were great for three years, but then Steve had a visit from a banker he didn’t know.

What Happened Next

The seller had neglected to tell Steve that the property was already encumbered by a first mortgage. For the first three years, the seller used Steve’s payments to handle that mortgage, but when the seller was fired from his job, he quit making mortgage payments and used Steve’s payments to live on. After the mortgage went 90 days delinquent, the bank foreclosed, and even though the process took a while, Steve was forced to move. While in this case, the seller did not intend to defraud Steve, the end result was still a disaster, and Steve had to find a new place for his family to live.

Contract for Deed Homes Nationwide

Contract for deed is popular in all parts of the country. A recent Bloomberg article said:

“Eight years after subprime mortgages all but disappeared, U.S. buyers with bad credit can still own homes. If they come up with a nominal down payment and stay current on their monthly bills, they’ll get title to the property — after as long as 30 years. If they miss one payment, their contracts say they could lose all their money and get tossed out.”

The deals often end badly for low-income buyers.

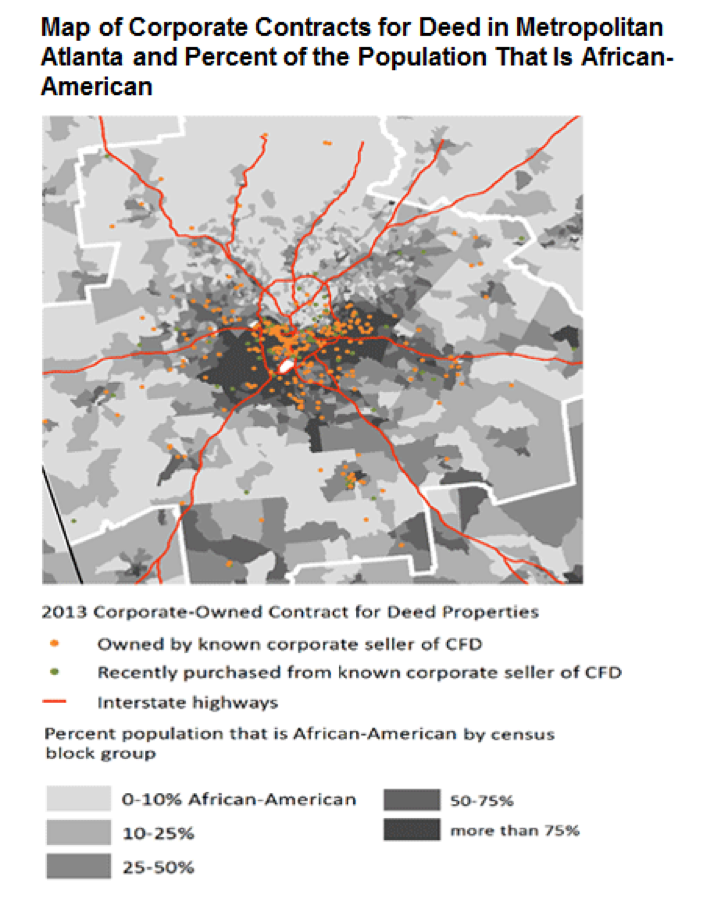

This chart shows the extent of contract for deed usage in Atlanta, Georgia:

Sources: 2010–14 U.S. Census American Community Survey, staff calculations based on 2013 CoreLogic tax data.

What Unscrupulous Companies Do

Two kinds of predatory contract for deed deals are prevalent today. The first one occurs when large companies buy foreclosed and unoccupied homes for pennies on the dollar. They then offer them for sale at inflated prices to persons that cannot qualify for conventional financing. Unlike Steve’s home, the sellers actually own the property free and clear of all encumbrances, but the homes are in bad condition and/or the monthly payments are structured to be extremely high. The sellers want the buyer to default so that they can quickly evict the delinquent tenant and repeat the process with new buyers.

The second scam works this way:

- Minnesota homeowner is behind on payments.

- Has a balance of $100,000 due on a $175,000 original mortgage.

- Buyer offers to “take care” of the mortgage issue.

- Pays off the mortgage balance and takes possession of deed.

- Resells home to original owner for $200,000.

- Original owner gets a MN contract for deed home for $200,000.

- Buyer essentially has stripped the equity from the home.

Is This Avoidable?

Interestingly, while the two examples above may be unethical, that are not illegal. Does this mean you should not consider for sale by owner homes MN with contract for deed financing? No, because there are reputable companies like C4D that strive to make the contract for deed process transparent, advantageous to both sides, and legal. Remember, it is always good to acquire legal advice before entering into a contract for deed.