Getting A Mortgage Loan If You’re Self Employed

https://www.c4dcrew.com/wp-content/uploads/2018/05/CONTRACT-FOR-DEED_-PROS-AND-CONS-23.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/0cd60208d9de9b4ec7236a52868375f0187854b5ee1fefa7603d0294819d3045?s=96&d=mm&r=gThe age-old self employed mortgage loan issue. You took the plunge and started your own business away from your family and you’re having success. Awesome, right!? Now you are no longer relying on a W2, so there are some hugely important things you MUST know when it’s time to apply for a mortgage.

It was undoubtedly a serious challenge to drive your business from inception to true profitability. You had to find your location—or build your virtual store—find vendors, get permits and licenses, hire your first employees, consult with lawyers and accountants, and then find and retain customers. Now that you are successful and you’re finally feeling better about surviving, why is it so difficult to get a home loan?

Banks Don’t Like You

Many entrepreneurs report that the initial visit to the mortgage lender’s office isn’t pleasant. Bank officers often cast a wary eye toward small business owners because:

- Stated income can be difficult to prove.

- Accounting records may be incomplete.

- Bankers think small business owners can be riskier borrowers.

- There is a perception that owner/operators conceal income and avoid taxes.

- Business owners commonly sign personally for business debt.

But does that mean you’ll never own a home?

Let’s take a look at this scenario: let’s say you’re a small business owner in Denver, Colorado. You might think that you’re stuck renting that one-bedroom Denver apartment forever, since you’re unable to prove income to the bank. So, what are the issues?

Income Issues with Self Employed Mortgage Loan

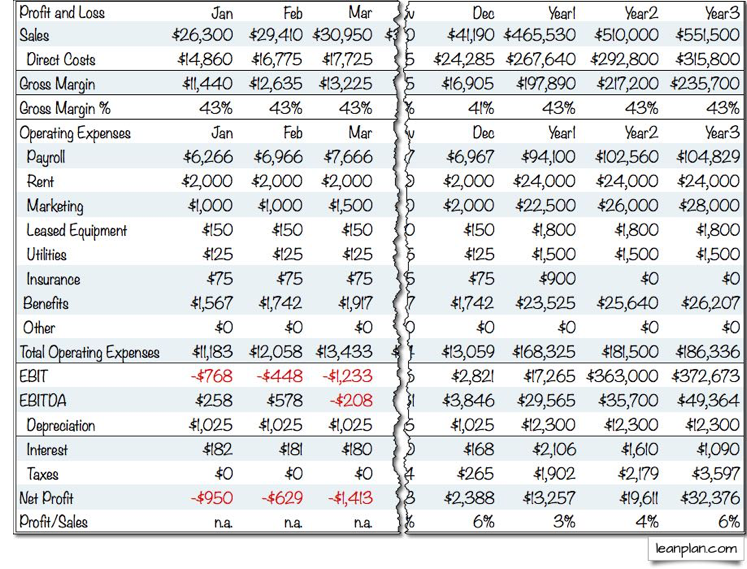

If you work for someone else, your paycheck goes toward your rent or house payment, car payments, various insurance obligations, repairs, maintenance, etc. If you own a business, however, your business may provide you with a car, a computer, health insurance, life insurance, meals, travel and more.

If you make $75,000 per year, for example, you can take your pay stubs to the bank and that will prove your gross income. If your business can produce $75,000 in gross profits, savvy business owners have their business make car and insurance payments directly, and by the time all owner benefits have been deducted, the business may show a much smaller profit, and the owner may legitimately report a smaller income amount.

Explaining to the banker that your $20,000 income is really $75,000 because of all the benefits your business provides you is not always met with quick acceptance.

Cold Hard Cash — Good For Self Employed Mortgage Loans?

Let’s face it, although some businesses are becoming cashless, there are usually opportunities for business owners to pocket cash without reporting it as income (make sure you know the rules). Unlikely that the bank will consider any unreported income as valid for the purposes of obtaining a loan.

Lots of Business Debt

While many think that entrepreneurs can obtain business loans without having to sign personally, this is usually not the case, and small business owners many times will have signed for substantial company loans. Banks typically treat these as personal obligations and can count them negatively when figuring debt to income ratios.

What Can You Do?

As you know, we agree that traditional mortgage financing is preferable, but when circumstances cause that route to be difficult, consider giving is a call at C4D. We are MN contract for deed experts and we understand that owning a small business should not be an obstacle to home ownership. We look beyond raw numbers to truly understand your financial situation, and we can work with a variety of circumstances. As our satisfied clients tell us, “Wow, you were able to help us when the bank said no!”