How To Find A Great Minnesota Realtor

https://www.c4dcrew.com/wp-content/uploads/2018/06/CONTRACT-FOR-DEED_-PROS-AND-CONS-28.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/0cd60208d9de9b4ec7236a52868375f0187854b5ee1fefa7603d0294819d3045?s=96&d=mm&r=gHow to find a good realtor? If you’ve tried, well, you’ve probably realized it’s not as easy as it sounds, right?

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without becoming a Realtor. If you are licensed in your state, you can help people buy or sell commercial or residential property. The State of Minnesota publishes a detailed booklet that explains the real estate licensing process, and you can find it here:

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without becoming a Realtor. If you are licensed in your state, you can help people buy or sell commercial or residential property. The State of Minnesota publishes a detailed booklet that explains the real estate licensing process, and you can find it here:

http://mn.gov/commerce-stat/pdfs/re-license-guide.pdf

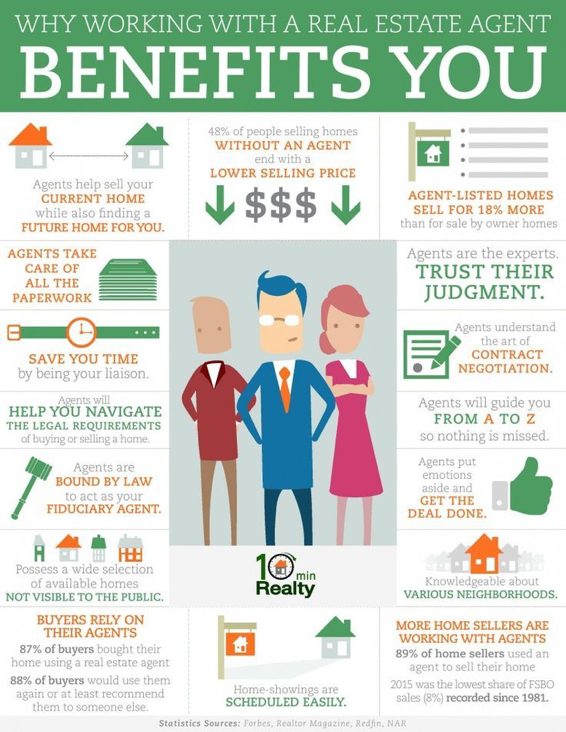

But don’t confuse licensed real estate agents with Realtors, because there is a difference. According to inman.com, “A Realtor is a trademarked term that refers to a real estate agent who is an active member of the National Association of Realtors (NAR), the largest trade association in the United States.” NAR has certain requirements and members must first agree to abide by its ethics code.

It doesn’t matter where you’re coming from; you might be moving from a small Cincinnati apartment to a Minneapolis single family home, but whether you contract with a real estate agent or a Realtor, it’s important that you know how to vet and find the person that best fits your needs. And bankrate.com says that these seven items are paramount.

Talk with agents’ recent clients.

At the first meeting, ask for a list of clients. If these are all relatives, beware, because your prospective agent may not be very experienced. Look for a track record of satisfied clients that are happy to provide referrals. While you may want to help a new agent break into the business, that may not be in your best interest.

Check for license and disciplinary actions.

Licensed real estate professionals are regulated, and if they have been disciplined, there will be a public record of this. Some ways agents get in trouble are:

- Forgetting who they represent.

- Co-mingling client funds.

- Seeking kickbacks from lenders.

- Showing incompetence.

- Forgetting that the interests of the client should come first.

Ask about professional awards.

OK, so million-dollar club status is not that hard to obtain, but awards do show that agents or Realtors have sold some properties.

Here’s a rundown from another experienced professional:

Select an agent with the right credentials.

If agent Paul Johnson sold your wife’s office building, that doesn’t guarantee that he knows anything about residential real estate. Similarly, an upscale Realtor that specializes in the Milwaukee suburbs may have a tough time understanding how to sell an inner-city property.

Find out how experienced an agent is.

How many clients? How many closings? How many accepted offers? How many failures? How many rejected deals? Ask these questions.

Look at the agent’s current listings.

If your prospective agent’s listings are all rural farmland, and you have a downtown condo to sell, you may have the wrong person.

Gauge the agent’s knowledge of the area.

Does your agent know the schools? The shopping areas? The crime rates? What the last 10 sales have been? A negative answer means you should look elsewhere.

Getting It Done

Most of all, you need to find someone that can get the job done. We at C4D are like that, because we specialize in MN contract for deed financing. We love traditional mortgages, but if you can’t get one, tell your Realtor to contact us ASAP. We can help where others have failed!