Minnesota Real Estate: C4D’s 2019 Outlook

https://www.c4dcrew.com/wp-content/uploads/2018/12/CONTRACT-FOR-DEED_-PROS-AND-CONS-29-1.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gMinnesota real estate has been strong in 2018.

Bigger metropolitan areas like Minneapolis-St. Paul have seen months where the median number of days on the market for typical homes was only 47. And check out these stats from the Minneapolis Area Realtor’s Association:

- New Listings increased 9.5% to 702

- Pending Sales decreased 6.7% to 723

- Inventory increased 1.0% to 9,487

- Median Sales Price increased 8.2% to $265,000

- Days on Market decreased 7.1% to 52

- Percent of Original List Price Received decreased 0.1% to 97.3%

- Months’ Supply of Homes for Sale increased 10.5% to 2.1

Median Sales Price Prior Year Percent Change

The trend is neatly summarized by this simple report about Minnesota real estate:

- December 2017: $248,000 – $226,000 (+9.7%)

- January 2018: $244,000 – $222,500 (+9.7%)

- February 2018: $250,000 – $221,650 (+12.8%)

- March 2018: $258,100 – $235,000 (+9.8%)

- April 2018: $267,000 – $245,000 (+9.0%)

- May 2018: $271,000 – $250,000 (+8.4%)

- June 2018: $270,500 – $257,250 (+5.2%)

- July 2018: $268,000 – $251,500 (+6.6%)

- August 2018: $268,000 – $252,000 (+6.3%)

- September 2018: $262,000 – $247,000 (+6.1%)

- October 2018: $265,000 – $244,000 (+8.6%)

- November 2018: $265,150 – $245,000 (+8.2%)

- 12-Month Median: $264,100 – $245,000 (+7.8%)

As you can see, Minnesota real estate prices have climbed steadily, and are continuing to do so.

Positive 2019 Factors in Minnesota Real Estate

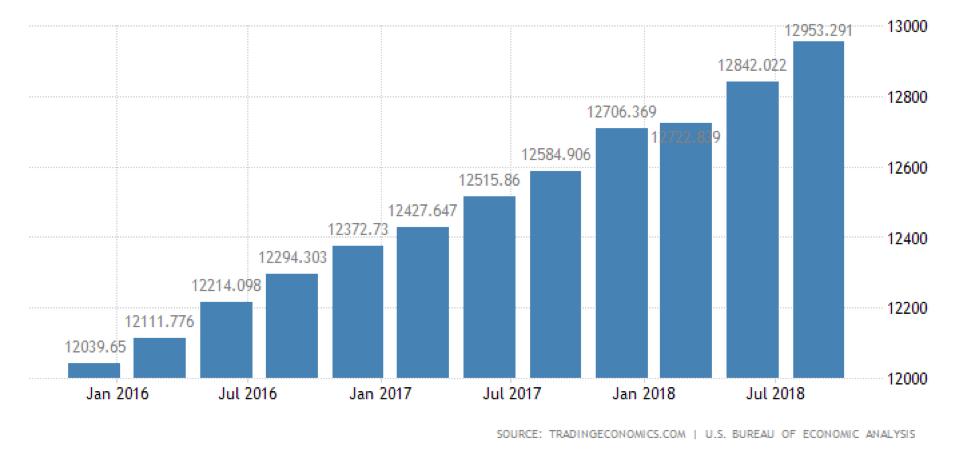

First, let’s look at the 2019 factors that may keep this real estate train running. The price of oil took a serious tumble in late 2018 to a present-day value of only approximately $45 per barrel; oil prices ripple through the U.S. economy and affect many sectors.

- Jet fuel prices will be cheap and that will help airlines make more money without ticket price increases.

- Gasoline and winter heating oil prices have declined with gas falling below $2.00 per gallon in many parts of the country.

- Anything made with petroleum like plastics will be cheaper to produce.

These trends mean stable prices and more money in the pockets of Americans. This is turn strengthens the economy as a healthy consumer sector makes the chance of a recession less likely in 2019.

The unemployment rate is nationally at record lows, and at what is considered full employment, wages start to increase, and that also leads to greater consumer spending power.

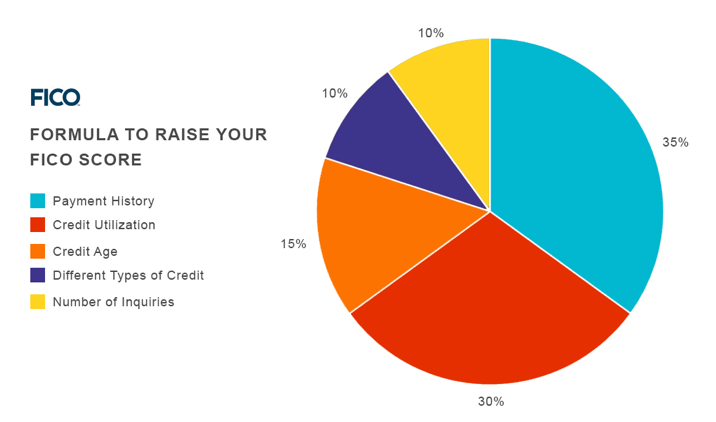

All of these factors mean consumers will be in better shape, will have better credit scores (you can still buy with bad credit!), and will be ready to buy more homes.

Minnesota Real Estate Negatives

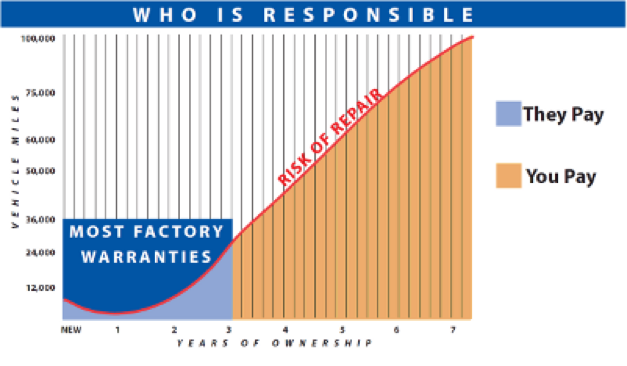

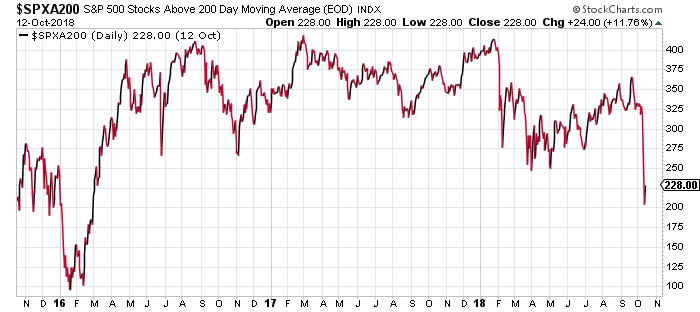

Two main problem areas are rising interest rates and stock market volatility. The Fed, concerned that the strong economy will overheat has been steadily raising interest rates from zero to a more “normal” level. This has caused mortgage rates to cross the psychologically perilous fiver percent mark, and higher mortgage rates may cause some potential buyers to sit on the sidelines.

Also, the recent stock market volatility has many wondering is a recession is indeed on the horizon as stock market declines usually predict a near-term downturn. As you know, a weaker economy will impact housing prices, and at the very least would flatten the market for a while.

So, our prognostication for 2019? We feel that if the economy even chugs along at a slower pace, housing prices will continue their increase. If a recession occurs, we really don’t see homes losing much value, but instead feel that things may just level off for a while.

Bankruptcy – What Is It?

Bankruptcy – What Is It?