7 Things Real Estate Agents Must Do For Sellers

https://www.c4dcrew.com/wp-content/uploads/2018/09/CONTRACT-FOR-DEED_-PROS-AND-CONS-13.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gYou need to be able to spot the signs of a bad Realtor when you see them. It’s a must!

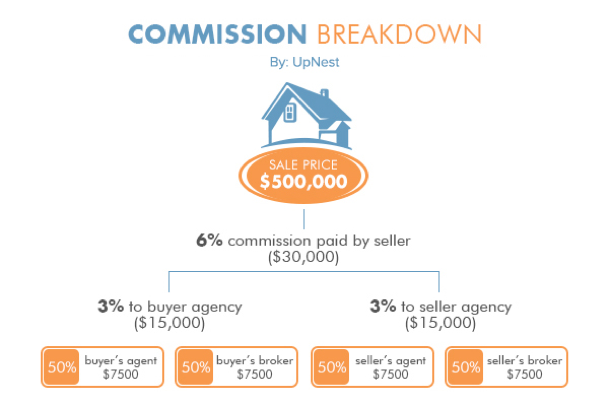

You can be paying big money to your listing broker when your home sells. If your property goes for $400,000, brokers could get $24,000. Sure, the listing broker will share commissions with the buyer’s agent, but still, that’s a lot of money. Because your Realtor is going to handsomely profit from his or her work, you can expect your agent to do the following.

Signs of a Bad Realtor #1: Doesn’t Correctly Price the Home

Your agent needs to have total local market knowledge and needs to know the price range where your home will sell. There is nothing worse than riding down the market as buyers wait for you to continually lower the listing amount of your over-priced home. Don’t think that Joe Smith—the guy that sold grandma’s condo in the suburbs—is automatically going to know how much your downtown unit is worth, unless he can prove that he understands your local market.

Signs of a Bad Realtor #2: Doesn’t Do A Great Marketing Job

Your expert should not be showing signs of a bad Realtor. Instead, they should use every available too to sell your home. Facebook, MLS of course, Craigslist, his or her network of brokers, Pinterest and any other Internet based platforms need to be used. Any postings and listings must be accompanied by great photos and excellent descriptions. If you have already moved, and your property is vacant, your agent needs to help you with staging. Signs of a bad realtor would include an agent that seems lazy and not Internet savvy.

Signs of a Bad Realtor #3: Does NOT Properly Communicate

Sellers are naturally hyper, and a good Realtor will inform them of his or her availability and communication preferences. If you aren’t presented with something like this right away, you maybe should look for another agent:

“I am available seven days a week by email, phone and/or text. If you contact me before 4:00 p.m., I promise to return your inquiry within four hours. If you contact me after 4:00 p.m., I will be in touch by noon the next day.”

Signs of a bad Realtor would be an agent that doesn’t return calls for days.

Signs of a Bad Realtor #4: Doesn’t Ensure That the Buyer is Qualified

DIY home sellers often make the rookie mistake of taking an offer without vetting the buyer. This can tie up a property for 30 days or more. Your agent needs to make sure that all offers to be considered are from bank pre-qualified buyers, or those that can show they have cash.

Signs of a Bad Realtor #5: Poor Negotiation Skills

Think about it — if you and the buyer are $5000 apart on a $400,000 transaction, that $5000 only means an additional $300 in commission for the brokers. The brokers, at that point, may just want to get the deal done and collect their $24,000 commission, and they would probably sacrifice $300 to be able to move on. You, on the other hand, may need that $5000, and a good broker will represent your interest, not his or hers.

Signs of a bad Realtor would be an agent that puts pressure on you to quickly agree to a lower offer.

Signs of a Bad Realtor #6: Doesn’t Attend the Home Inspection

The home inspection carries a lot of weight, and you need to be represented at the inspection. That way, you’ll know what the inspector sees as problems before he sends his report to the buyer. It is better to be surprised early than at the last minute.

Signs of a Bad Realtor #7: Can’t Finalize Loose Ends for Closing

Hearing the words “clear to close” is a great thing, and your agent should be with you every step of the way to help make this happen. He or she needs to be in constant contact with the buyer’s broker, the title company, the bank, and the inspector.

You’ve made a wise decision if you have hired a Realtor during the home buying process —just make sure you and your broker agree upon expectations.

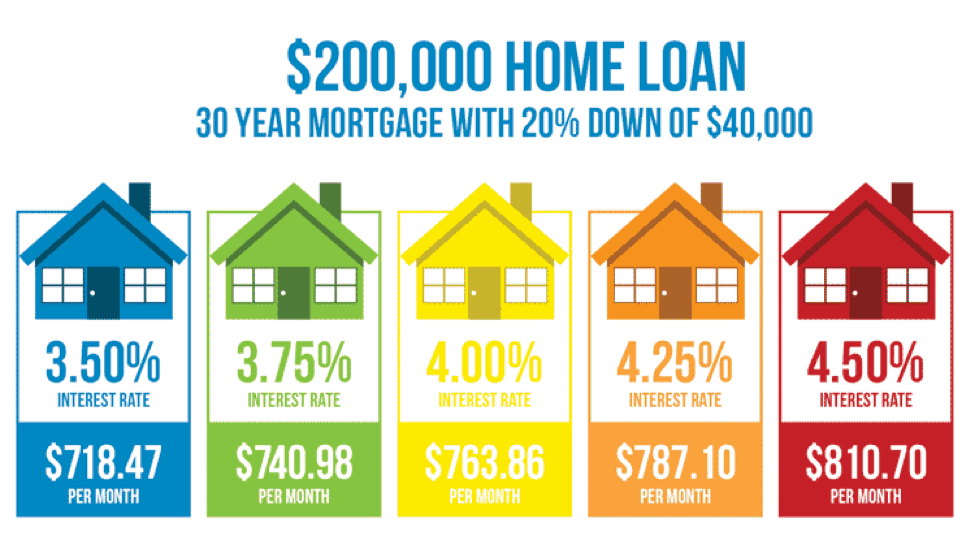

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference: