Bad Credit Home Financing: The Bad Credit Blues

https://www.c4dcrew.com/wp-content/uploads/2018/03/CONTRACT-FOR-DEED_-PROS-AND-CONS-15.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gSo, you’re at a company happy hour listening to your co-workers talk about their new home purchases. Becky just closed on a four-bedroom steal close to downtown and is looking for remodeling contractors. William finally finished a complicated deal where he traded a rental property and another investment property for equity in a new home. Stephanie has perfect credit and her husband works at Goldman so she’s complaining that she can no longer get a mortgage rate below four percent.

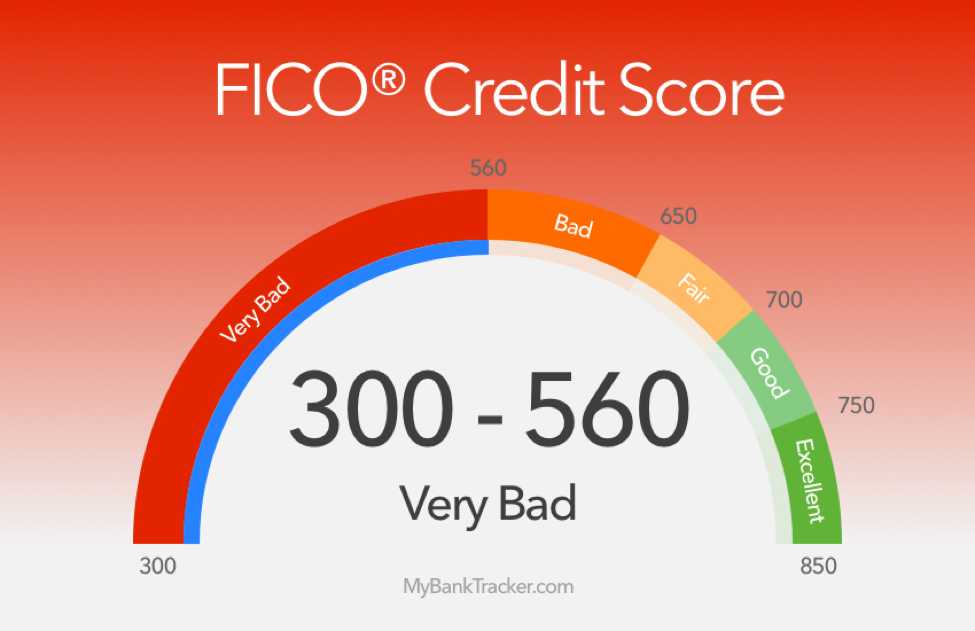

And you’re still in your cramped old apartment on 10 1/2 Ave S. in St. Cloud. You have student loans, a couple of late credit card payments, a few parking tickets that have gone to collection, a delinquent hospital bill from when you drunkenly fell on the sidewalk, and you’re just thinking, “WTF, am I ever going to be like everyone else? I’ll be renting forever.”

You’re thinking that bad credit home financing is impossible.

There’s Always a Way

Lots of famous people have said, “don’t give up,” and while we’re sure you don’t want to see their names listed here, the basic premise is true. If you have MN bad credit, if you have been turned down for a mortgage, if the only credit card offers you get are from an Indian Reservation in South Dakota, and if the only auto dealer that will talk to will happily sell you a used car — but at 29 percent interest — YOU CAN STILL OWN A HOME!

Alternative Financing

Creative people find creative ways to get a home purchase accomplished, and here are some ways to try:

- Get a co-signer

- Fix your credit

- Have someone else buy it for you

- Win the lottery (yeah, sure…)

- Investigate rent-to- own

- Engineer a contract for deed sale

Bad Credit Home Financing … Yeah, Right

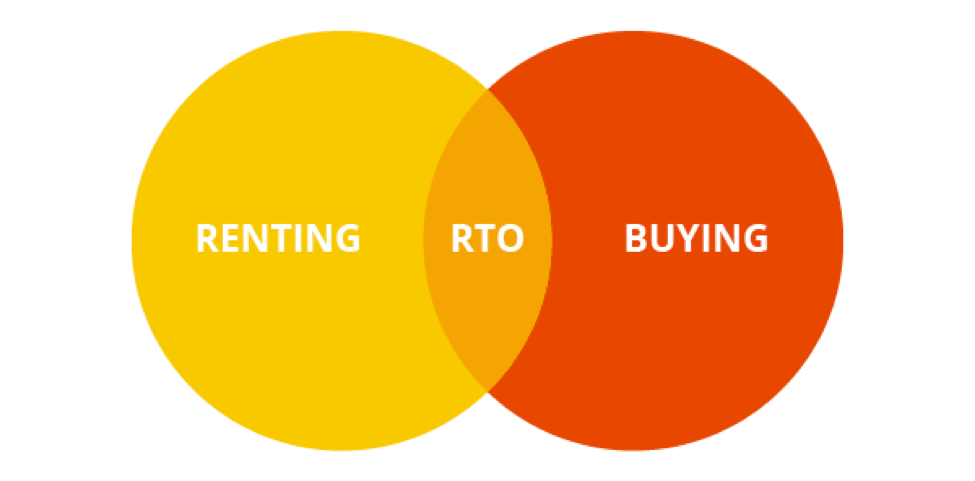

OK, so one through four above are long shots like Colin Kaepernick getting picked up by New England next year, but the last two methods can work. Wikipedia defines rent-to-own this way:

“Rent 2 Own also known as rental-purchase, is a type of legally documented transaction under which tangible property, such as furniture, consumer electronics, motor vehicles, home appliances and real property, is leased in exchange for a weekly or monthly payment, with the option to purchase at some point during the agreement.”

That’s all well and good, but there are some issues here. Miss a payment and you’re gone. You’re not really gaining equity—just some down-payment dollars. There are lots of scams that have been traditionally associated with rent-to-own.

The Better Choice

To be honest we really like contract-for-deed. In Minnesota, it’s a very popular home financing method. It’s regulated, it’s not uncharted territory, and many, many people have found their way to home ownership through contract for deed MN. There is a great place to find out valuable info regarding this often-used financing method, and that is C4D. We are reputable, know what they are doing, and have a really informative website. Whether you work with us or not, realize that there are ways to get a home — just be diligent, creative, and do some research.