Actionable Tips For First Time Home Buyers in 2018

https://www.c4dcrew.com/wp-content/uploads/2018/04/CONTRACT-FOR-DEED_-PROS-AND-CONS-19.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/0cd60208d9de9b4ec7236a52868375f0187854b5ee1fefa7603d0294819d3045?s=96&d=mm&r=gWhew! It seems everything has accelerated in the past couple of years. You graduated from college, got married, landed a nice job, and now there is a child on the way. Your apartment in Chicago on the 32nd floor is just not going to do it anymore, so it’ s time to think about purchasing your first home. Where to even start? Well, how about starting right here. Here are some great tips for first time home buyers.

Tips for First Time Home Buyers: Your Realtor

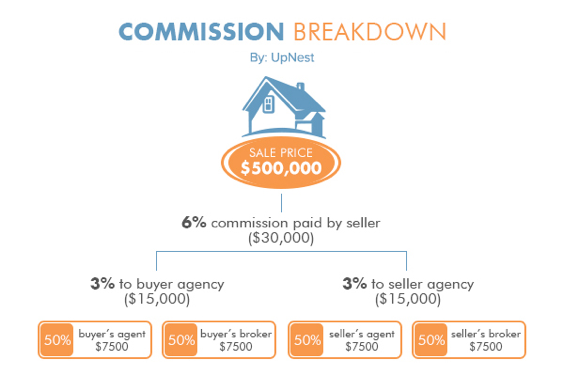

Establish a relationship with a buyer’s agent. You’re looking to your agent for tips for first time home buyers, so after you explain your needs and price range, this person will find properties for you to view, make the appointments, keep a record of what you have seen, negotiate deals and write up offers to purchase. And guess what, there is no cost to you, since the seller pays all commission expenses!

Next Tip: Clean Up Your Credit History

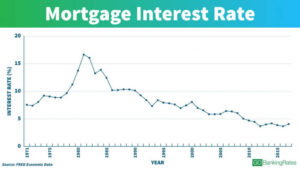

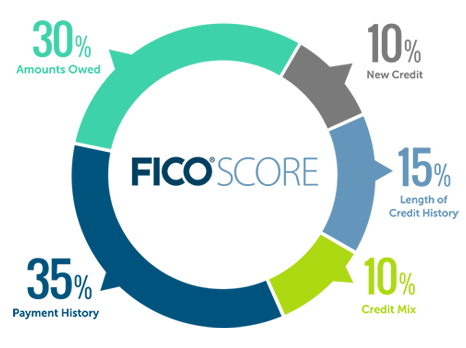

Bad MN credit can be a problem as it can injure your ability to get good bank financing at the lowest possible rate. Go to Credit Karma, look at your credit score, view your credit report, and dispute any errors you find.

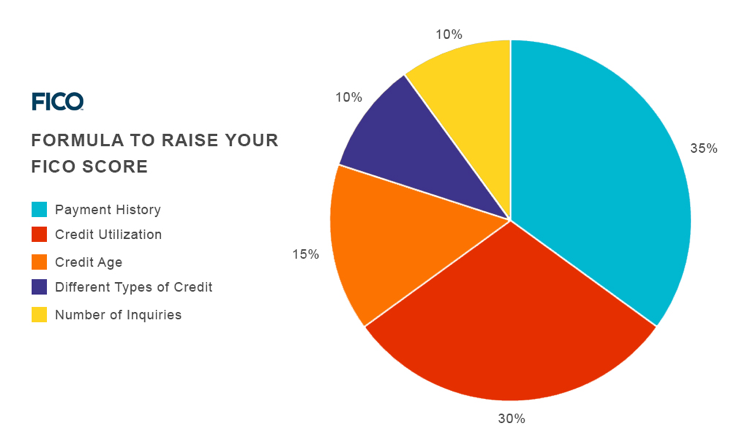

Tip #3: Pay Down Those Cards

As any Minnesota mortgage lender will tell you, if you have a high credit utilization rate, your projected monthly mortgage payment will be higher. Savvy first time home buyers plan well in advance to reduce credit card balances.

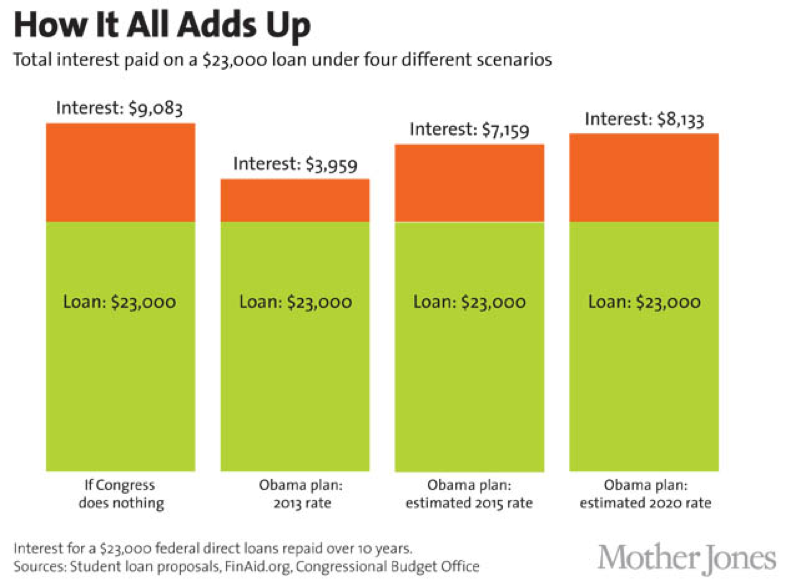

Tip #4: Work on Those Student Loans

As Student Loan Hero tells us:

“Spending a few more years getting your student loans or other debts paid down could mean that you would qualify for a lower interest rate or a higher loan amount. Once you have a better credit history and more secure income history, you will have more options available when you finally are ready to take that leap into homeownership.”

Become aware of the many repayment options available to MN student loan holders, and strengthen your monthly cash flow.

First Time Home Buyer Tip #5: Save for that Down Payment

You will be asked to show that you have anywhere from three to ten percent or more down-payment money available. While some lenders allow you to accept this money as a gift from your relatives, others like to see that you have saved it. Few lenders, however, will accept a borrowed down payment. You can also look into something like a home improvement loan as well.

Tip #6: Be Realistic and Discerning

Our friends at U.S. News tell us:

“When you look at houses, focus on the right things. Don’t be distracted by the owner’s odd décor, paint colors, dirty carpet or anything that is easy to change. Granite countertops and stainless-steel appliances are easy to add later. You can’t easily add another bedroom, a better location or a more functional floor plan.”

Tip #7: Be Serious and Ready to Go

Don’t casually look for houses without having a plan to move if you find your dream house. You could find a gem on day one, but be stuck for six months in an apartment lease. Great opportunities may present themselves fleetingly, and you need to be ready. But be prepared to take some time to shop around for home insurance — don’t forget about this!

Tip #8: Check Out the Neighborhood at Different Times of Day

That nice, quiet three-bedroom dream home may turn out to be a nightmare if you only saw it on a quiet Sunday afternoon. Check traffic patterns and activity at different times before you make an offer.

Tip #9: Talk to the Neighbors

No one can give you a more realistic view of the area than someone that has lived there for years. Knock on doors, talk to people you see, and frankly ask them if the neighborhood is a good place to live. You’d be surprised at the genuine answers you will receive.

Be sure you check in on the home and neighborhood safety as well. You don’t want to become just “another statistic.”

Final First Time Home Buyer Tip: Don’t Give Up

If you have found your dream home, but have been turned down for conventional financing, there are alternatives. C4D, our company that specializes in helping those with bad credit in Minnesota, may be able to help you find your path to home ownership through a contract for deed. Go here to find out more about this legitimate and widely used method that can get you into a home even if you have credit issues.

And if you’re looking for even more tips for first time home buyers, you can check out some more great information from our friends over at Bankrate. They have a fantastic blog post which shares many more tips for first time home buyers. You can check it out here.