Rent to Own: The Ultimate Guide (2019 Updates)

https://www.c4dcrew.com/wp-content/uploads/2019/07/CONTRACT-FOR-DEED_-PROS-AND-CONS-4.png 1000 500 Taylor Witt Taylor Witt https://secure.gravatar.com/avatar/c007419611804209e46af7a884e93ad9?s=96&d=mm&r=gYou want to buy a home, but you really, truly don’t have the money. Can you get started anyway with a rent to own agreement? Let’s answer this question: “how does rent to own work?”

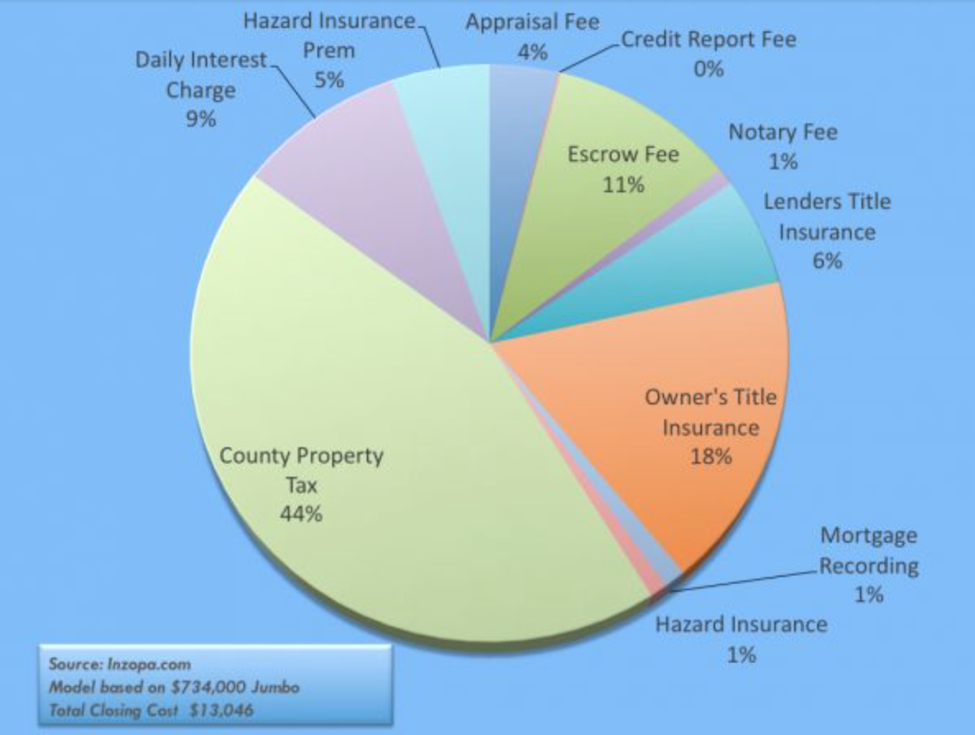

Most prospective homebuyers want traditional mortgage financing. They want to be able to go to a bank, get a low interest rate, be offered reasonable closing costs, and they want to maximize their home-buying power. The problem is that with a poor credit score that can be due to any number of factors, traditional financing just may not be available for all home buyers.

But really, how does rent to own work?

Well, while renting a home may be attractive to some because of the low maintenance costs and the ability to move without the problems of listing and selling a property, many feel that money spent toward rent is totally wasted since in effect, the tenant is paying the landlord’s mortgage.

There is, however, a method that allows a tenant to get future equity in return for their monthly rent payments, and that is called rent to own. So, now you’re asking, how does rent to own work?

How Does Rent to Own Work

Investopedia explains rent to own in a simple and understandable manner:

- A rent-to-own agreement is a deal in which you commit to renting a property for a specific period of time, with the option of buying it before the lease runs out.

- Rent-to-own agreements include a standard lease agreement and also an option to buy the property at a later time.

- Understand that lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it.

- You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

- With some rent-to-own contracts, you may have to maintain the property and pay for repairs.

Executory Contract

Rent to own deals are usually designated by law as executory contracts. legaldictionary.net gives us a nice definition here:

An executory contract is a contract made by two parties in which the terms are set to be fulfilled at a later date. The contract stipulates that both sides still have duties to perform before it becomes fully executed.”

Each state has specific rules and guidelines regarding executory contracts and rent to own would fall under that umbrella. And while rent to own has been in existence for many years, because of landlord abuses, some state courts—like these in Texas, for example—have been more tenant-friendly than landlord-friendly when rent to own disputes arise.

Minnesota Statutes sections 325F.84, et. seq. require that:

The lessor is regularly engaged in the rental-purchase business;

The agreement is for an initial period of four months or less, whether or not there is any obligation beyond the initial period, that is automatically renewable with each payment and that permits the lessee to become the owner of the property;

The lessee is a person other than an organization; and

The lessee takes under the rental-purchase agreement primarily for a personal, family, or household purpose.

How It Works — Exactly

Rent to own can appear in different forms, but many times the landlord will offer to take a portion of the month’s rental price and apply that to either a down-payment for the house, or to the full purchase price. This purchase price must be agreed upon in advance, and the tenant must agree to purchase the home at that price.

For example, if the tenant has agreed to pay $200,000 for a home, and in the meantime rents the home for $1500 per month, the landlord may offer a rent to own deal where $500 of the monthly payment is credited to either a down-payment—in the case of seller financing—or to the purchase price.

If the tenant lives in the home and makes all of their payments for 10 years, this would equal $60,000, and if the term had been set at 10 years, the landlord would be obligated to sell the property to the tenant for $140,000.

The tenant must carefully think about contract terms and consequences because if they are unable to get conventional financing for the home after the 10-year period, there needs to be an agreement for resolution of this problem. Either the landlord would have to offer seller financing, or maybe even refund the tenant’s $40,000. It must be emphasized that individual rent to own contracts can differ greatly, so tenants are advised to get quality legal representation.

Abuses

Some rent to own contracts are written to favor the landlord, and, in the past, predatory landlords would offer a rent to own deal to a tenant knowing full well that the tenant would not be able to afford the monthly payment. If a tenant missed a payment, the landlord could void the rent to own contract and evict the tenant. This way, the tenant would lose all of their investment, and the landlord would be free to perpetrate this abuse again and again. This is one reason that Texas views rent to own executory contracts with a very wary eye. All in all, if you’re a Minnesota renter living in something like a one-bedroom apartment, be sure you know all of the potential rent to own issues that could arise.

Other Issues

Other issues to consider are:

- Who pays the property taxes?

- Who is responsible for maintenance?

- Who replaces broken appliances and/or major systems?

All of these potential problems need to be spelled out carefully in the rent to own contract. We strongly suggest that prospective rent to own tenants and landlords do not download generic executory online contracts and then attempt to tailor them to a particular situation because this action can be the proverbial recipe for disaster.

Rent to Own Alternatives

Rent to own can be a decent method to at least get some monetary credit for monthly rent payments, and it can be successful if both the tenant and landlord are forthright and have the same goal of enabling the tenant to own the property one day.

We do suggest that anyone that has been denied traditional mortgage financing consider MN contract for deed financing. Contract for deed is also non-traditional home financing, but it is also a great alternative to just renting.