Minnesota Contract For Deed: 2018 Realtor Guide

https://www.c4dcrew.com/wp-content/uploads/2017/09/ForRealtors-1024x451.png 1024 451 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gAs a Minnesota Realtor, you have probably seen some bizarre and arbitrary loan rejections, but that doesn’t make you or your client feel any better. Approaching a lender for bad credit loans may not help since their rates can be predatory. What you do need to do is find a lender that will facilitate a contract for deed deal.

For example, you’re confident that you have a reasonably qualified client, and you’ve found them the perfect home. Your client is excited, has a down-payment, you write the offer, it’s accepted, and you’re off to the bank. The bad news comes quickly, however, as the lender claims that your buyer doesn’t qualify for financing. According to GoBanking Rates, buyer financing can be denied for not only a weak debt to income ratio but also for any of the following reasons:

- A recent job change.

- Credit report errors.

- A property appraisal that comes in less than the purchase price.

- Old liens and judgments.

- Recently opened or closed credit card accounts.

- Early retirement.

- Excessive business debt.

- 1099 income/inability to prove written off expenses.

- Questionable tax returns.

- Inability to substantiate where the down payment came from.

Legitimate Financing with Contract for Deed

The Minneapolis Federal Reserve Bank wrote a great article explaining the methods, risks and benefits of a contract for deed to finance Minnesota real estate. They simply state:

In a contract for deed, the purchase of property is financed by the seller rather than a third-party lender such as a commercial bank or credit union. The arrangement can benefit buyers and sellers by extending credit to homebuyers who would not otherwise qualify for a loan. Indeed, public and nonprofit housing advocacy organizations have used the contract for deed as a tool to help low- and moderate-income households attain homeownership.

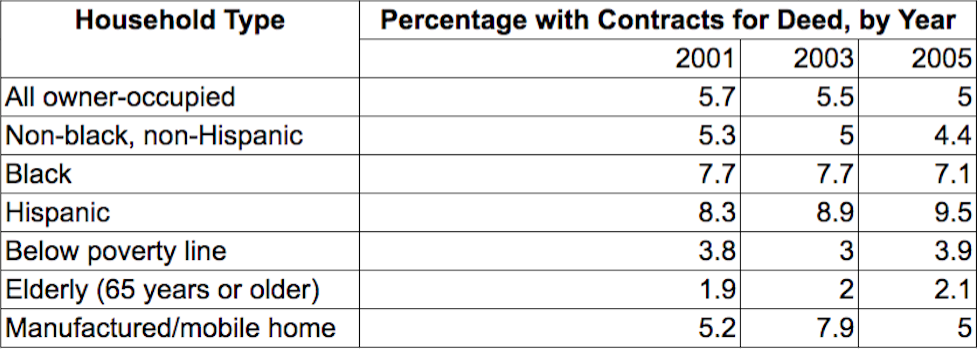

This U.S. census bureau chart shows a solid percentage of contract for deed homes and Hispanics are major subscribers to this type of bad credit loan solution.

Owner-Occupied Homes with Contracts for Deed in The U.S.

Source: American Housing Surveys 2001, 2003, 2005, U.S. Census Bureau.

Source: American Housing Surveys 2001, 2003, 2005, U.S. Census Bureau.

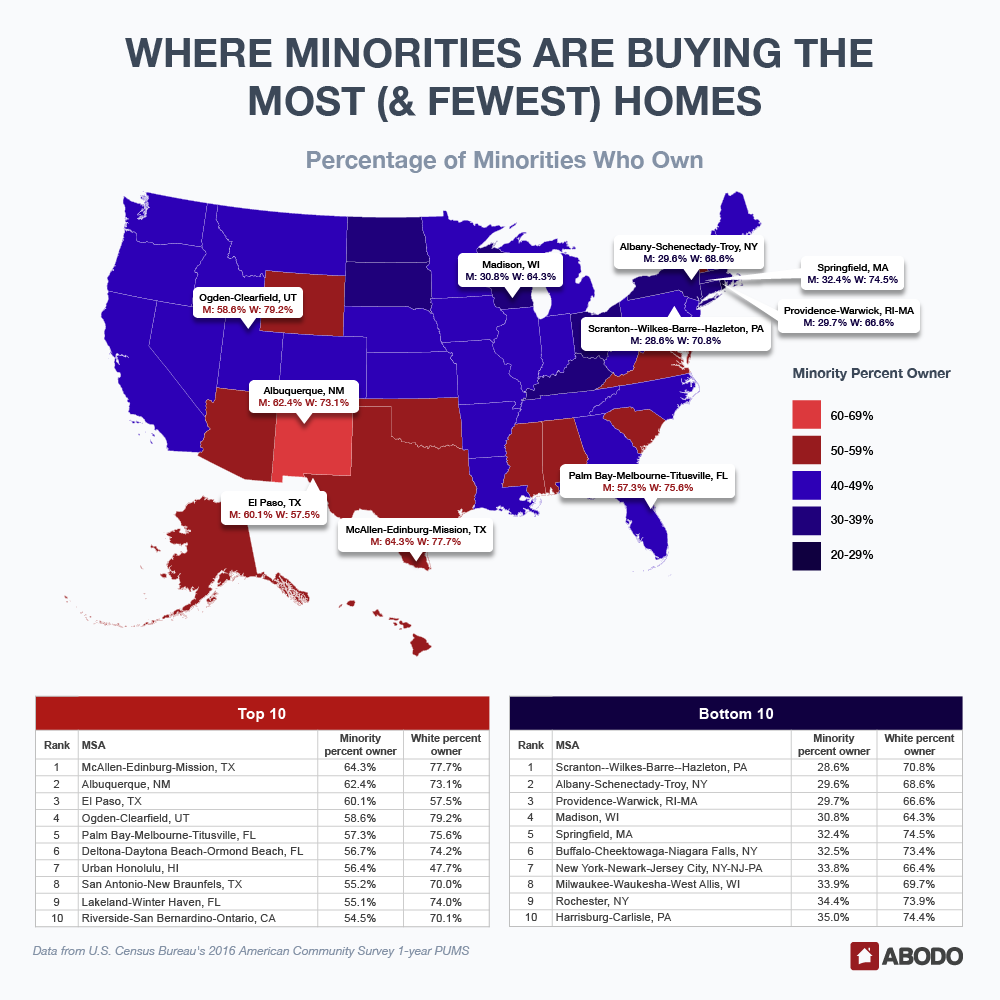

Minorities Want To Buy Homes

Furthermore, this recent report from ABODO shows Realtors in Minnesota exactly where minority homebuyers are active, and Minnesota is right in the middle at 40 – 49 percent.

The Mechanics of Contract for Deed Minnesota Financing

For individual contract for deed sales to work properly, the seller must realize that they will not get the full purchase price immediately. Instead they are offering an installment plan sale to their prospective buyer. While the buyer will gain immediate occupancy, the seller still holds the deed will remain the owner of the property until all payments are made. This is a great path to home loans with bad credit for the buyer, but the seller, again must be in a position to take installment payments rather than receiving a lump sum payment.

Free and Clear … and Legal?

Contract for deed Minnesota home financings are simpler if the seller owns the property free and clear of all liens and mortgages. This way, the seller must wait until all installment payments have been made, but since there are no third parties—like banks—to deal with, all of the money goes to the seller; they merely have to wait longer to get the total amount due them.

While a seller with a bank mortgage on a property could sell that property on a contract for deed basis, this could be a problem for a buyer since the seller’s original mortgage may prohibit this type of transfer, and that could put the buyer at risk, if the bank discovers the sale.

In many states, especially Texas, this kind of solution to a loan with bad credit is done frequently. When the buyer asks about the due on sale clause in the seller’s original mortgage, the usual reply is “the bank will never find out, and if they do, they won’t care. Banks would never foreclose on a property if someone is making the payments.” Yes, this may be the case in some situations, but you as a Minnesota Realtor know that it is not prudent to believe that someone “would never” do something.

How You Can Get This Done

Luckily, there are companies like C4D. C4D specializes in Minnesota contract for deed deals. Unlike some individual sellers, however, C4D does not put the buyer at risk with original mortgage due on sale clauses because their banks do not require them. C4D has spent years developing solid banking relationships, and this drives successful and mutually beneficial financing arrangements.

How Contract for Deed Actually Works

Certainly, Minnesota real estate professionals should try first for conventional bank financing. If this fails, however, take the deal to C4D. C4D will analyze the situation, and quickly let you know if they can help. Minnesota Realtors understand that while C4D cannot automatically take any deal, they do have the approval leeway that many banks just do not possess.

C4D looks at every deal individually and independently. This is not cookie-cutter lending because C4D understands that all situations are different. Some loans may require different down payment percentages, and in certain circumstances, C4D can even help secure down payment dollars.

If a deal is approved, C4D physically buys the property from the seller and offers a contract for deed to the buyer. As in classic contract for deed financing, the seller owns the property, but the seller is now C4D.

Contract For Deed Is Simple

Since the 2009 meltdown, mortgage approval can be tricky. You can have a great buyer but the banks just say no. If this happens to you, bring your deal to C4D—a local Minnesota company—and see what they can accomplish. By the way, your Minnesota Realtor commission is totally unaffected by this process, and you will receive the full amount upon contract execution.

What are the Next Steps?

If you have any questions about Contract for Deed financing, you can always contact us here.