2018 Realtor Tips: Handle Rising Interest Rates

https://www.c4dcrew.com/wp-content/uploads/2018/05/CONTRACT-FOR-DEED_-PROS-AND-CONS-21.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gRising interest rates in real estate — sounds awful for both homebuyers and realtors, right? Well, you’re in the right place find out. Below, the C4D Crew will outline what factors influence interest rates and what rising interest rates mean for the real estate industry.

The 2008 housing crash was hard enough to deal with. Besides the record foreclosure numbers, Realtors had to deal with very tight lending conditions along with a new and stringent set of government banking regulations. Gone are the days of wild west type appraisals and easily obtained no income documentation loans. While this period has been replaced with a mortgage market some would call the “new normal,” there is an evolving twist MN Realtors now must deal with.

Rates Are Going Up

Mortgage rate predictions for 2018 and 2019

|

Agency |

2018 Prediction |

2019 Prediction |

| Mortgage Bankers Association | 4.9% | 5.4% |

| Freddie Mac | 4.6% | 5.1% |

| Fannie Mae | 4.5% | 4.5% |

| Realtor.com | 5.0% | No forecast |

| National Association of Realtors | 4.5% | 4.8% |

| Kiplinger | 4.7% | No forecast |

| National Association of Home Builders | 4.5% | 5.0% |

Early in the recovery, nicely qualified buyers could actually get 30-year traditional mortgages at rates around 3.25 percent. Now, rates are nudging up to the psychological five percent barrier. Simple math shows us that a $200,000 mortgage at 3.25 percent costs $870.41 per month. At five percent, however, the payment jumps by $203.23 to $1073.64.

To get that payment close to $870.00 with a five percent interest rate, the mortgage amount needs to drop to $165,000. This is a significant 18 percent drop in purchasing power. In other words, a buyer that could have qualified for a $200,000 mortgage at 3.25 percent, now may only be able to finance $165,000.

What Do Rising Interest Rates Mean?

CNBC reported in February:

Sales of newly built homes are falling, and the culprit is clear. Homebuyers increasingly can’t afford what they want. Higher mortgage rates, combined with the loss of homeowner tax breaks in some of the nation’s most expensive markets, are taking away buying power.

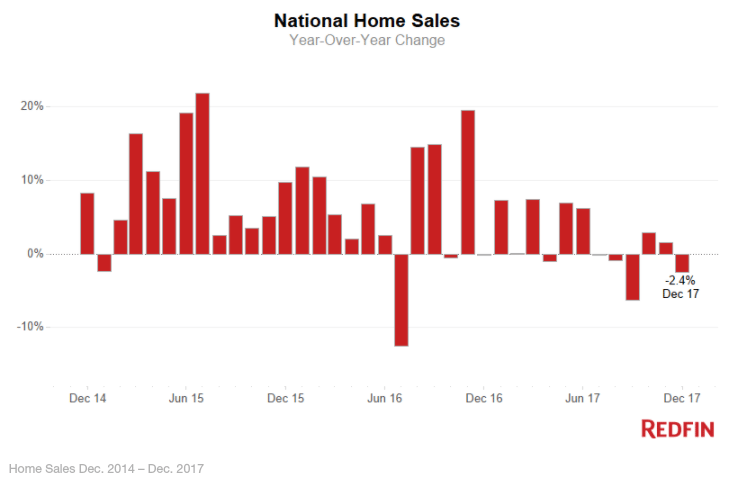

Image source: Redfin

Sales fell in December, when the new tax law was signed, and then again in January, when mortgage rates moved higher. Sales are now at their lowest level since August of last year.

“It seems that the jump in mortgage rates in January had an immediate impact on contract signings,” wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group. “You can’t get more interest rate sensitive when it comes to homes and cars with the associated cost to finance.”

What Realtors Can Do

Savvy Realtors need to understand that while upward interest rate trends can be an issue, there are some ways this situation can be managed. Sellers can make things easier by offering to pay closing costs buyers certain remodeling credits, or of course lowering sale prices.

Buyers may need to rethink their plans for an ultimate dream home and take an intermediary step instead of a final one. Maybe that $350,000 home will have to wait and a $240,000 will have to work for now.

Make It Happen Now

The upward interest rate trend is no secret, however, and Realtors should push both sides to get deals done before rates rise even more. Lock in today’s rates as soon as possible as each Federal Reserve interest rate hike will do more damage to the housing market.

Consumers Getting Priced Out?

In a rising interest rate environment, more consumers are going to be priced out of traditional mortgage financing, and this is where we at C4D can help. Using MN contract for deed, we make deals happen that banks have refused. We understand bad credit issues, and we want to help ensure that good people that may have had some financial issues are able to become homeowners. Don’t give up on your rejected traditional mortgage deal; instead, bring it to C4D and we will see if we can help.