20 Tax Deductions Every Realtor Needs to Know

https://www.c4dcrew.com/wp-content/uploads/2019/01/CONTRACT-FOR-DEED_-PROS-AND-CONS-33.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/0cd60208d9de9b4ec7236a52868375f0187854b5ee1fefa7603d0294819d3045?s=96&d=mm&r=gYour clients continuously ask you about the tax benefits of buying a home, but are you aware of all of the realtor tax deductions available for your own business?

You need to be aware of the Realtor tax deductions available to you; if not, you are wasting your hard-earned commissions by giving a present to the government. Remember, when we speak of listing Realtor tax deductions, we are talking about money that you can deduct from your income, and if you have substantial 1099 income, you know how important these amounts are.

Mileage

You can deduct the miles you drive in the course of doing business. Be sure to keep a log of these just in case. For 2018, you can deduct 58 cents per mile, so if you drove 10,000 miles for business last year, you could deduct $580.

New Car

Car lease payments are another great Realtor tax deduction. You will need to reimburse your business for any personal use of the business vehicle, however.

Home Office

You can charge your business rent for a home office, utilities, Internet and cable, as long as you can show that your business used the percentage you are deducting.

Real Estate Software

Contact management, open house, and lots of other software applications work great for Realtor tax deductions.

Cell Phones

On your phone all day? Let your business pay for it.

Office Stuff

Papers, pens, ink and even paper clips are all valid Realtor tax deductions.

Phone Answering Service

If you outsource your phones when you are not in, an answering service is deductible along with any other virtual services you use like virtual bookkeepers and assistants.

Office Rent

If you rent an office away from your home, the rent is 100 percent deductible.

Office Equipment

Desks, printers/scanners/fax machines, computers and servers are all legitimate business expenses.

Internet/Phone

Of course Internet service is deductible and so are landline and mobile phone services.

Advertising

Your monthly newsletter and email marketing are business expenses and therefore deductible. Marketing tools like business cards and signs are deductible, and so are the fees you pay to an outsourced social media marketing company.

Entertainment and Travel

A portion of these costs can be deducted, but be sure to check with your CPA about the correct deductible percentages.

Conferences and Conventions

Realtor tax deductions can include registration fees for conferences and conventions.

Ride-sharing

Take an UBER or a Taxi? Be sure to save your receipts.

Client Meals and Entertainment

50 percent of what you spend on these can be deducted from your 1099 income. Saving receipts is very important here.

Gifts for Clients

Spend what you want, but only $25 per gift per client is deductible for 2018.

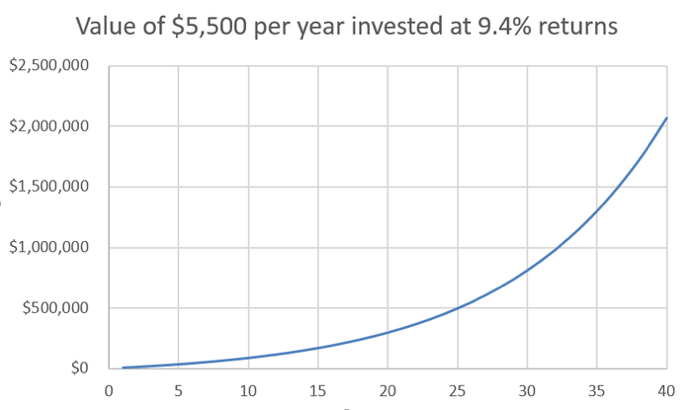

IRA Contributions

These will work as Realtor tax deductions up top certain amounts, so connect with a professional to find out what the limits are.

Shared Workspace

Just like office rent, this is a deductible expense.

Continuing Education

Have to take a class to learn about current market trends? Be sure to deduct the tuition cost.

Dues and Memberships

Your Realtor association fees and other business group memberships are great Realtor tax deductions.

Organization is the key to getting the most tax value from your business activities, so make sure you keep track of expenses and document everything. Be sure to consult with your tax professional if you have any questions.