Should You Consider Contract for Deed Financing in 2021?

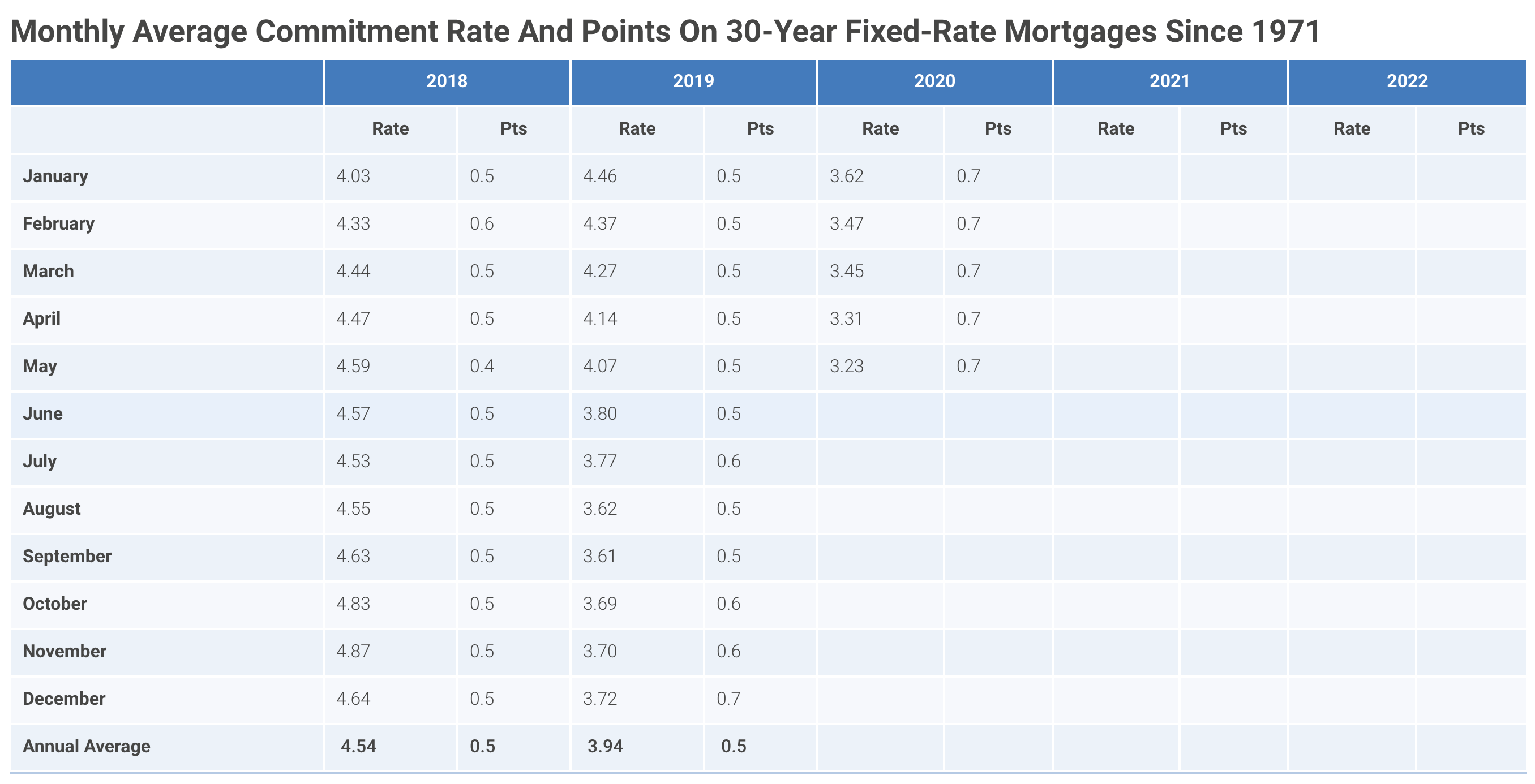

https://www.c4dcrew.com/wp-content/uploads/2020/12/C4D-Post-Design-1.png 1000 500 Taylor Witt Taylor Witt https://secure.gravatar.com/avatar/c007419611804209e46af7a884e93ad9?s=96&d=mm&r=gInterest rates are at record lows. Housing prices are at record highs. Multiple offers are the norm in some cities. You really want to buy a home, but the last time you tried to get a mortgage, you were denied. Worse, with COVID-19, a weakening stock market, an uncertain future, and post-election trauma, lenders are clinging to tight underwriting standards.

If you have a low credit score combined with some serious recent credit dings, conventional financing could be very difficult to obtain. Let’s look at some alternatives that can get you into your own home in 2021, including contract for deed.

Find Someone to Cosign

If you can’t qualify for a mortgage, find someone that can. This might be a relative, a friend or even your employer. A person with excellent credit that will agree to be on the hook for your mortgage can be the answer to your credit difficulties. Rocket Mortgage puts it best as they say, “When someone cosigns on a mortgage loan, it means they agree to take responsibility for the loan if you default. Cosigning on a loan isn’t just a character reference.

It’s a legally binding contract that makes another person partially responsible for your debt.” Just make sure that your prospective cosigner understands their legal obligation.

Think About a Duplex

Sure, you want a single-family home, but checking out a multifamily situation might be an eye opener. With a duplex you can rent the other side of your home and possibly collect up to half—or even more—of your monthly mortgage obligation. If you can show that you only need to come up with $1000 of your own money to make your $2000 monthly mortgage payment, you may be able to qualify without a cosigner.

The Simple Dollar expounds on this as they mention, “One reason buying a duplex is such an appealing idea is that there’s a lower barrier to entry than if you were buying a free-standing rental property. We already mentioned how you typically need at least 20% to put down on a single-family investment property, but the rules are a lot different if you’re buying a property to live in yourself.”

Don’t Leave Deals on the Table

Research all of the financing avenues that may be available to you. If you are a veteran, for example, you can get a no-money-down mortgage even in you have a very low credit score. VA loans are great if you are a first-time home buyer.

In addition, bet you didn’t know this, courtesy of the USDA:

“The USDA Loan is a mortgage option available to some rural and suburban homebuyers. USDA Home Loans are issued by qualified lenders and guaranteed by the United States Department of Agriculture (USDA). USDA Home Loans are particularly favorable to those living in rural or low-income areas. USDA Loans offer $0 money down, lenient eligibility requirements and competitive interest rates – due to the loan being guaranteed by the USDA.”

Rent-to-Own

In states that allow it, you might want to look at a rent-to-own deal. In these situations, someone that owns a home free and clear will rent it to you and apply part of your monthly rent to a future down payment. At some time, you will be able to purchase the home from the owner, and many times the owner will act as the bank and finance the property. While this arrangement does work for some, there is room for difficulty with this arrangement. Sometimes unscrupulous owners will enter into a deal they know will be difficult for the tenant to keep, i.e., an inflated monthly payment, and if a late payment occurs, that can be quickly followed by an eviction. In these cases, all down payment money is usually lost, and the owner then looks for another victim.

Contract for Deed

If your credit is just not up to par, if you can’t find a co-signer, if duplexes aren’t your thing, and if rent-to-own sounds too risky, consider contract for deed. In some states like Minnesota, contract for deed deals have been utilized for years. The Morris Law Group explains the process well:

“Instead of purchasing a home with a mortgage, the buyer agrees to directly pay the seller in monthly installments. The buyer is able to occupy the home after the closing of the sale, but the seller still retains legal title to the property until all payments have been made under the contract; actual ownership passes to the buyer only after the final payment is made. Contracts for deed have long been a financing option for property transactions between family members or friends. Some nonprofit housing organizations also use them to help low-income families find a path to homeownership.”

The C4D Crew takes this process a step further as they will work with you when you find a home you want to buy. C4D will buy the home you are interested in, and then they will sell it to you on a contract for deed basis. You don’t have to find a free and clear home, nor do you have to convince a reticent homeowner to enter into a contract for deed deal. These guys do it all.

Of course, your credit will need to be checked, but C4D understands that bad things happen to good people and they can look past issues like tax problems, divorce, job loss, and even a recent bankruptcy.

Yes, if you can find traditional financing that’s great! But if you can’t, and you want a legitimate way to own your own home, you really need to consider contract for deed financing.