Homeowner’s Insurance: A Guide to Your First Policy

https://www.c4dcrew.com/wp-content/uploads/2018/11/CONTRACT-FOR-DEED_-PROS-AND-CONS-25.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gWhile homeowner’s insurance cost is always a major factor, there are other important things to look at as you purchase your first policy. In fact, many insurance and real estate professionals state that focusing only on homeowner’s insurance cost can cause trouble if a major disaster strikes and property insurance is to be relied upon for reimbursement. Let’s look at steps you can take to avoid future issues.

Get Enough Homeowners Insurance

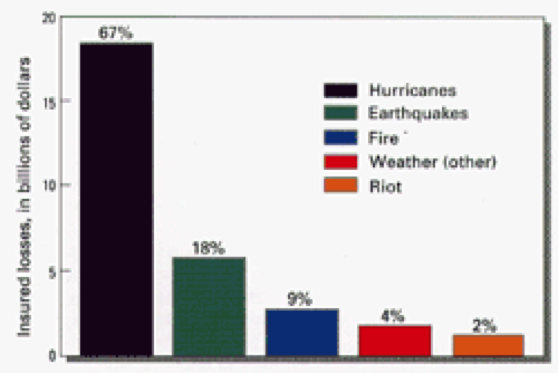

Being underinsured is a big problem. If you insure your home for $200,000 but it costs more than that amount to restore everything to pre-disaster status, you can find yourself with a costly problem. Work with your agent make sure that your home is totally covered for replacement cost. Sometimes the extra premium amount to do this is minimal, but if construction costs have risen since you first bought your insurance, a hurricane, tornado or fire can present you with a big bill to restore your premises, even after insurance has paid its share.

Deductibles: What Does That Really Mean?

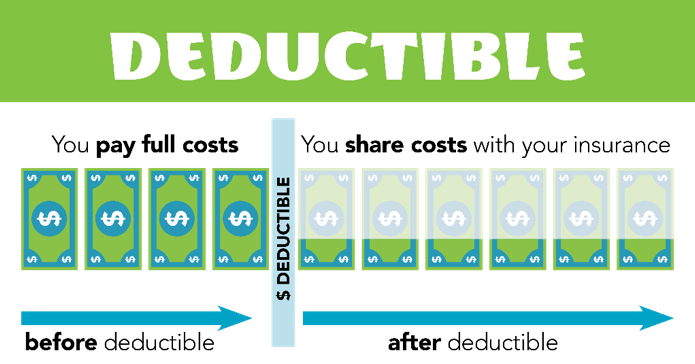

Your deductible is the amount of money you have to pay toward a claim before your insurance kicks in. Simply, if you have $5000 in roof damage due to a covered peril like hail, but you have a $1000 deductible, your insurance will pay only $4000 and you’re stuck with the rest of the bill.

Furthermore, deductibles used to be expressed in monetary terms like $250, $500, or $1000. Now, it is more common for deductible limits that are equal to a percentage of your home’s value. So, on a $300,000 home, a tiny-looking one percent deductible amount would actually be a whopping $3000.

Discounts on Homeowners Insurance Cost

Do check for discounts since the combination of auto and homeowner’s policies can get you a great break on homeowner’s insurance cost. There are also discounts available for fire protection, security systems, remote security solutions, and even wind-resistant shutters in some areas.

Customization of Your Policy

The flood damage experts at BMS CAT told us that, “there are some policies in some areas that do not cover every peril like floods. In fact, true flood damage is usually not covered, so if you live in a flood-prone area, you may be able to purchase FEMA flood insurance, although this isn’t cheap.” Also, watch out for stingy insurance company history. Sometimes insurance companies fight about water entering a home. They may consider it an uninsured flood event, while you may maintain that the water was wind-driven rain. Check with your agent on this.

Video for Proof

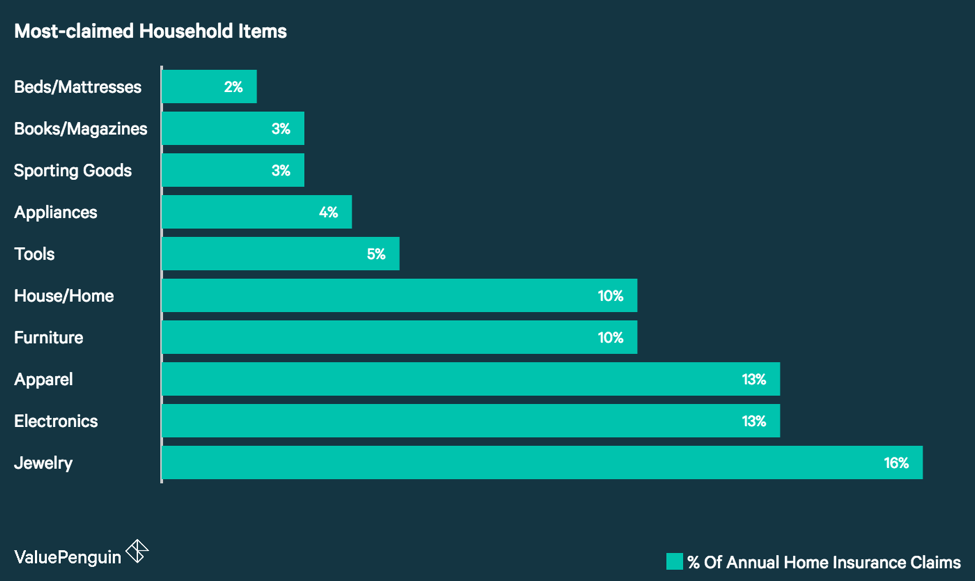

Finally, take a video of all of your belongings and upload the files to a cloud-based server. That way, your record of exactly what you own will be preserved. Also, make sure you disclose special possessions like jewelry and musical instruments as these may have to be “scheduled,” or you may even have to buy a separate personal articles policy in order to ensure coverage.

Image source: ValuePenguin

If you thought that your days of carefully vetting documents were over when your purchase offer was accepted, think again, personal finance is more complicated than that. Your homeowner’s insurance policy is your lifeline to security, so remember to spend time choosing the proper policy, and don’t base your decision totally on homeowner’s insurance cost. Also, be sure to read up on the best personal finance books, so that you know exactly what you’re reading!

As always, feel free to contact us with any questions!