Millennials Overcoming Mortgage Rejection

https://www.c4dcrew.com/wp-content/uploads/2018/02/CONTRACT-FOR-DEED_-PROS-AND-CONS-5.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gWhat is a Millennial doing in 2018 with regard to home buying? Does anybody actually know?

We’ve even been told millennials aren’t buying homes because they buy too much Avocado toast.

Getting a traditional mortgage approval can be a great relief, but some millennials may have a problem qualifying for their first home because of the following:

- Bad credit

- High student loan balances

- Less-than-solid credit history

- Too few open accounts

- Too many open accounts

- Credit report errors

- Unpaid tickets

- Low credit score

- Unfavorable debt to income ratio

- Low down payment

- No down payment

- Maxed-out credit cards

What to Do If You’re Denied a Mortgage

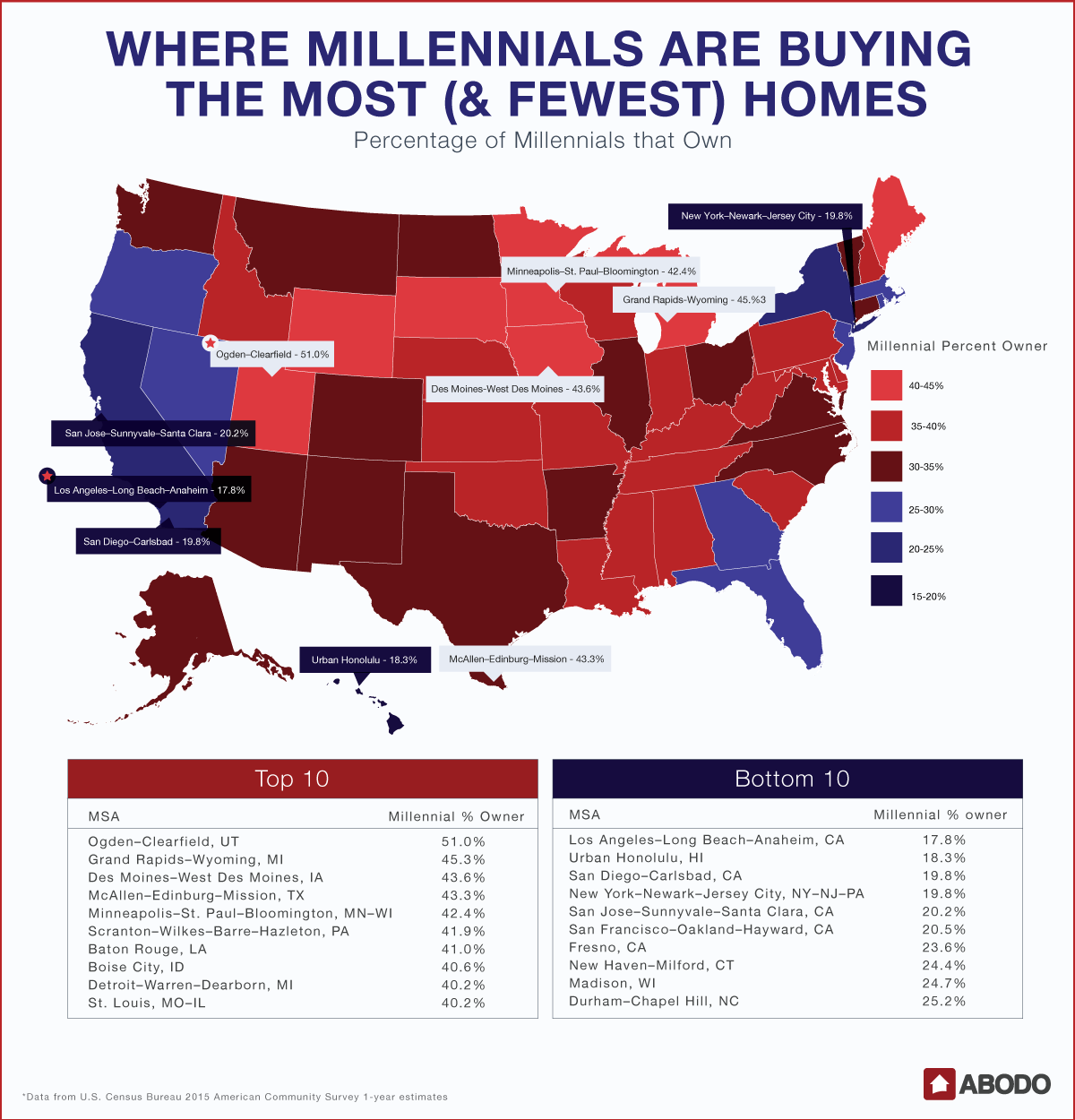

This report (and chart to the right from ABODO Apartments) shows us that millennial home buyers are all over the country, even if they’re buying at a slower rate than expected. If millennial home buyers can’t get financing, here are seven ways they can overcome mortgage rejections:

1. Credit Report Errors

Always get a copy of your credit report before you apply for financing. If you’re a millennial home buyer and you haven’t done this, however, don’t worry, because if you find incorrect information on your report, you can get it removed. Doing that can substantially increase your credit score and could result in a decision reversal. Credit Karma is a great place to start.

2. No Down Payment

Of course, you know that down payments are usually required for Minnesota home loans, but you may not be aware that lenders demand to know where the money originated. If you take cash advances on your credit cards and max out your lines, lenders will not be too pleased. A down payment gift from a relative or friend is many times acceptable as long as you disclose where the money came from.

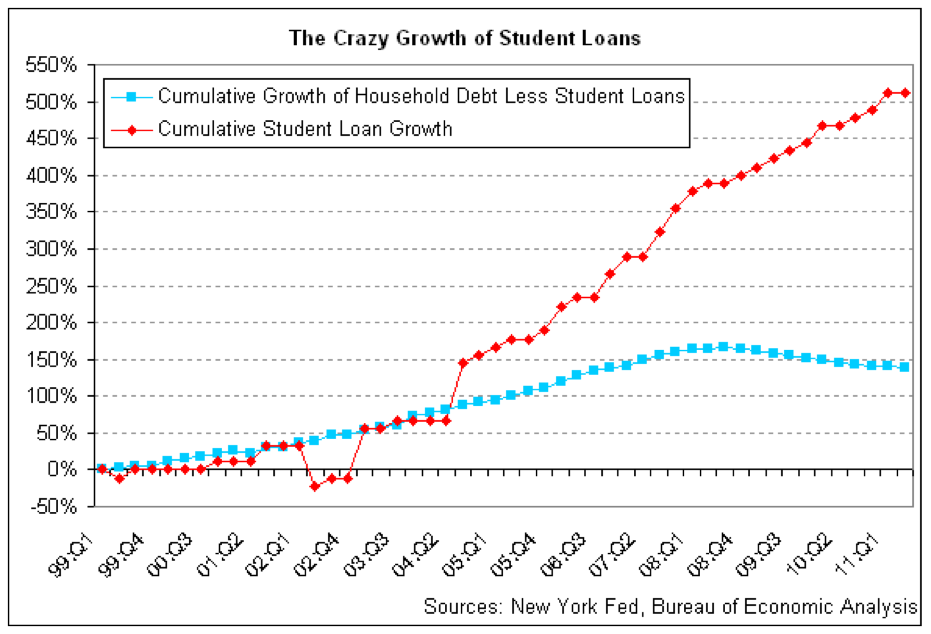

3. Student Loans

Massive student loan debt is often the norm, but if you have delinquent loans, or worse yet, defaulted loans, this can cause a quick mortgage application rejection. Make sure that all of your student loans, both private and federal, are in good shape. Go to the NSLDS to find out your federal loan balances. Mortgage lenders do have new rules to follow regarding the payment amounts they have to consider in relation to your income, so high loan balances alone may not be the problem you they are.

4. Credit Cards

High credit card balances negatively impact your credit score, so to position yourself for mortgage application acceptance, you need to pay these balances down before you apply. Lenders like to see that you are using only about 30 percent of your credit lines.

5. Try Seller Financing

If the above remedies aren’t available to you, there still are ways to purchase your first home. InvestorWords says that creative financing is “Any financing arrangement other than a traditional mortgage from a third-party lending institution.”

First, see if your seller will agree to act as the bank. The cleanest way to do this is to have the seller be the mortgagor—just like a bank—and give you the deed for the house in exchange for a small down payment and monthly mortgage payments. Of course, the seller may charge you a higher interest rate because he or she may consider you to be a higher credit risk as they agree to make what they consider a bad credit loan.

6. Rent to Own

If you have found your dream home but just can’t get it financed, see if the owner will let you rent the home while crediting all, or a portion of your rent to a down-payment. These Minnesota bad credit loan transactions can be complicated and risky, but rent to own has worked for many buyers, especially with a homes for sale by owner MN that is motivated. And according the industry leader HousingWire, tech companies like Divvy Homes are working hard to revolutionize the rent to own market.

7. Contract for Deed

Minnesota contract for deed is a proven legal method where a seller gives a buyer immediate home occupancy. The seller retains the deed, but when the buyer has made all of the agreed upon monthly payments, the buyer gains ownership. While less risky than rent-to-own, those interested in contract for deed Minnesota financing should check with their legal team before entering into any such agreement. Also, there are reputable companies like C4D that will work with you to accomplish the contract for deed transaction.

If you were rejected for a mortgage, first try and correct the application deficiencies that caused the issue. If that doesn’t work, you may want to look to creative financing to solve your MN bad credit loan problems.