26 Real Estate Terms Defined for New Buyers

https://www.c4dcrew.com/wp-content/uploads/2018/11/CONTRACT-FOR-DEED_-PROS-AND-CONS-22.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gBuying real estate can be complicated, and some of the real estate terminology can be confusing. Be sure to refer to this comprehensive guide when you need some clarification.

1) Adjustable rate mortgage

As opposed to a fixed rate instrument, your actual interest rate can move up and down at pre-determined intervals according to whatever index it is associated with.

2) Amortization schedule

A chart that shows exactly how much of your monthly payment is applied to principal, and how much is applied to interest.

3) Appraisal

An independent accounting of what a property is worth. Lenders will require to this to make sure the home they are financing is worth the loan amount.

4) Assessed value

What taxing authorities say your home is worth. This can be changed annually.

5) Buyer’s Agent

A real estate professional that represents the prospective buyer and is therefore entitled to part of the sale commission.

6) Closing

The meeting where the deal is finalized. Money is usually transferred that day or the next day.

7) Closing costs

These are the loan processing and various other costs that can equal two to five percent of the home’s purchase price.

8) Contingencies

Contract clauses that can allow either party to exit from a deal. An example is contract section that explains if the buyer cannot get financing within a certain period of time, the deal is off.

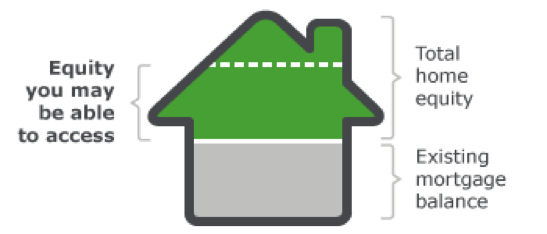

9) Equity

The difference between the market value of your home and any loans you have against it.

10) Escrow

An account that certain monies like down payments are placed into pending closing a deal. After the loan is closed, banks often require insurance and tax payments to be escrowed also.

11) Fixed-rate mortgage

A mortgage rate that can’t change no matter what happens to subsequent mortgage rates.

12) Home warranty

Usually purchases from a third party, these instruments help pay for problems after the sale has been consummated.

13) Inspection

Done by an independent person, this process checks the house for problems that may have to be addressed before the sale.

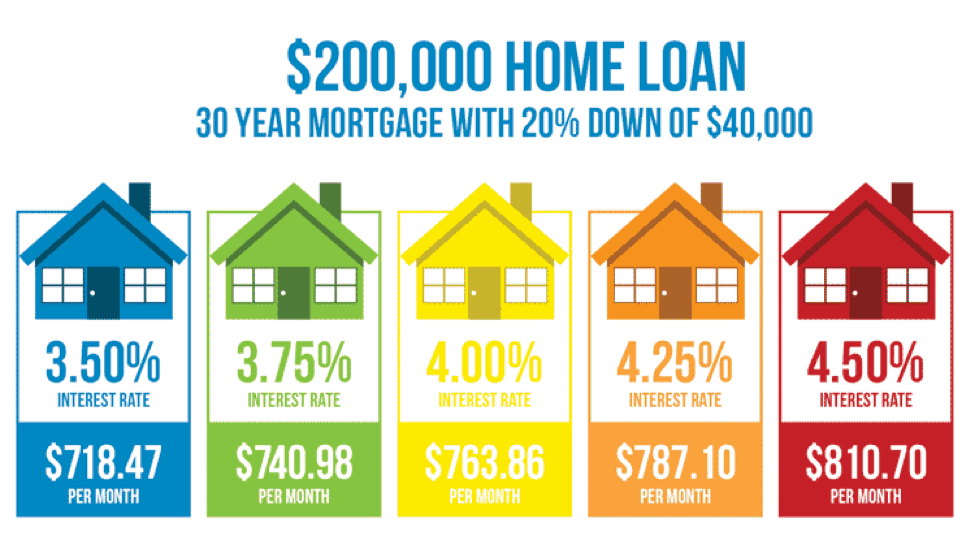

14) Interest

The price you pay for money expressed as a yearly percentage. This is an important piece of real estate terminology that you must understand.

15) Listing Agent

In a transaction, the seller’s agent.

16) Mortgage broker

A third party that finds appropriate lenders for buyers.

17) Offer

The legal document that spells out the buyer’s proposed terms of purchase.

18) Pre-approval

Buyers can go to the lender, present financial information, and get pre-approved for a loan. Pre-approval is not usually binding, however.

19) Principal

The amount of money that needs to be financed after your down-payment has been subtracted. This seems like a simple, easy to understand piece of real estate terminology, but make sure you fully understand this concept before searching for a home.

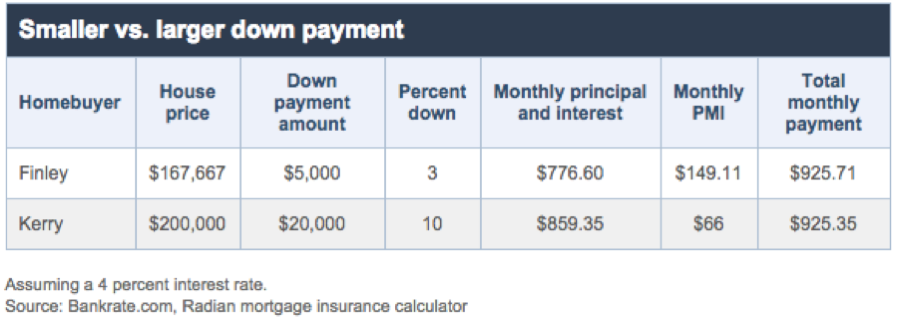

20) Private mortgage insurance

Insurance that the buyer pays for in monthly payments. It protects the lender against default.

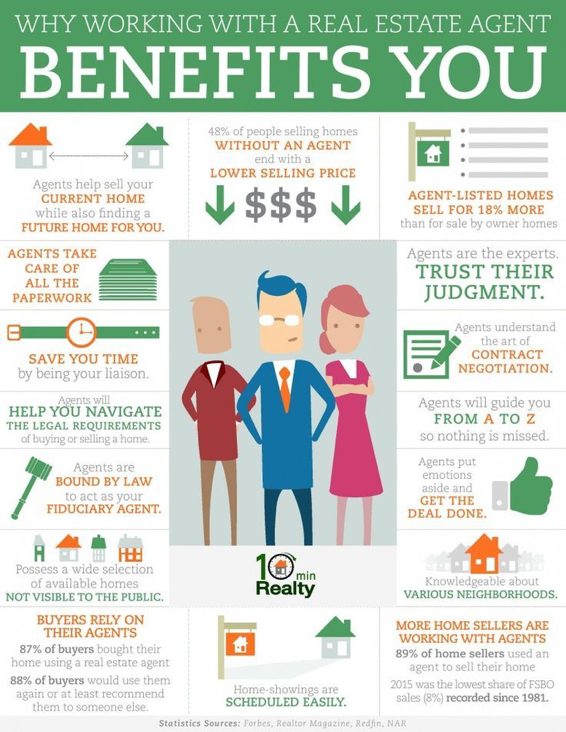

21) Real estate agent

Someone with a real estate license who has passed certain exams and who works with a real estate broker. This should be a very familiar term to many; because whether you’re buying a home in Minnesota or renting an apartment in affordable Eugene, Oregon, it’s likely that you’ve worked with an agent.

22) Real estate broker

Someone that has met certain requirements and who hires agents to work for him or her.

23) Realtor

A real estate agent that is a member of the National Association of Realtors (NAR). NAR has ethical and business standards that members must follow.

24) Refinancing

Restructuring a home loan to get a more reasonable rate or pull equity money out.

25) Title insurance

A policy that both sellers and buyers must purchase that protects that parties in a transaction against title deficiencies.

26) Contract for Deed

A unique process widely used in Minnesota that, when used correctly, can allow those that have been denied credit a real chance at home ownership.

As you can see, real estate terminology can be tricky, but by becoming familiar with this list, you’ll have a better understanding of what’s going on during your deal.

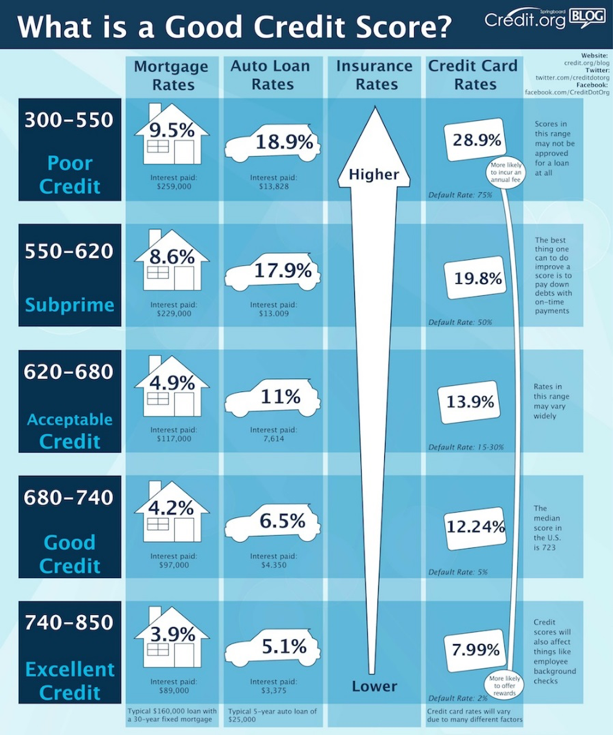

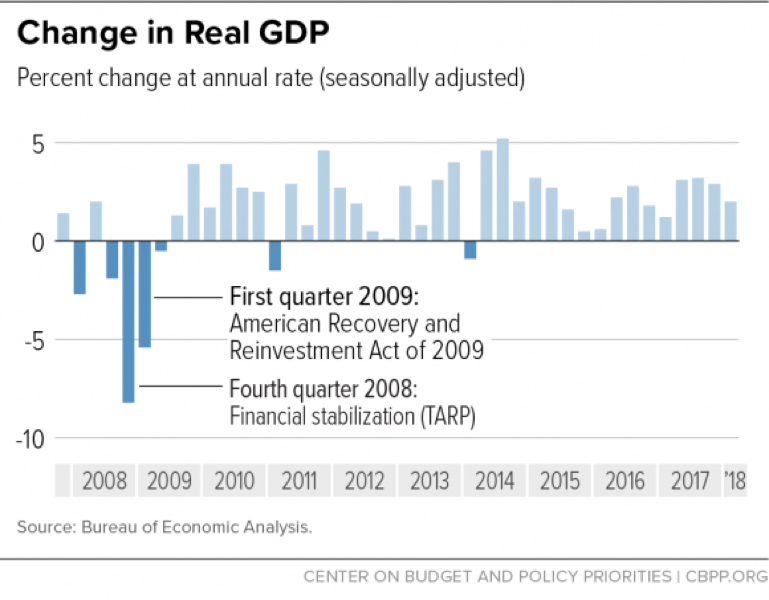

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without