[2019 UPDATES] Contract For Deed: The Ultimate Guide

https://www.c4dcrew.com/wp-content/uploads/2018/05/CONTRACT-FOR-DEED_-PROS-AND-CONS-5.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gContract for Deed Home Financing in 2019

Contract for deed home financing is a great option for those individuals struggling to get a traditional loan from the bank. Now, let’s get into the details.

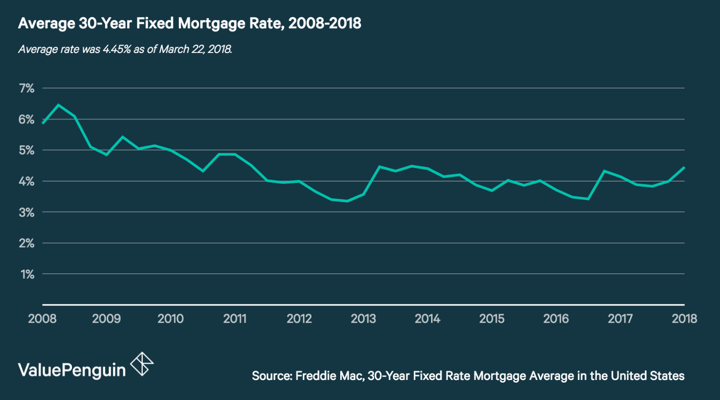

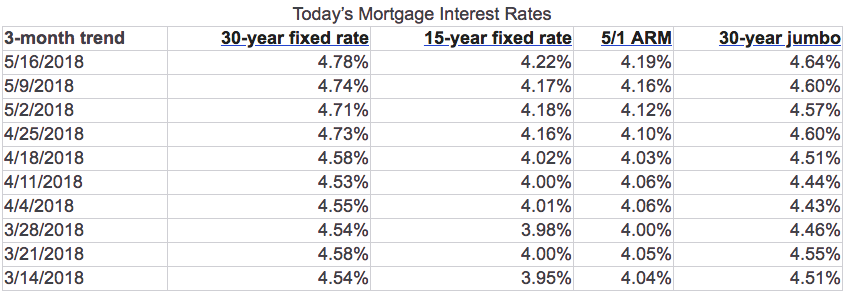

Conventional financing, in 2019, as we all know, is the preferred home loan vehicle. This refers to a standard mortgage loan from a licensed lending institution, and typically can be a15 or 30 year loan with a down-payment that ranges from 3 percent to 20 percent. The higher your credit score, the better deal you will get.

Even before you find your dream home, you should obtain mortgage pre-approval from your lending institution. While pre-approval does not guarantee that everything will go smoothly, it does provide you with significant negotiating power when dealing with sellers.

Applying For Conventional Financing

Your parents probably had to spend an afternoon at a banker’s office when they applied for their first home loan. Now, you can do this by phone or online, although you will eventually have to sign closing documents in person. Some important things to do and factors to be aware of are:

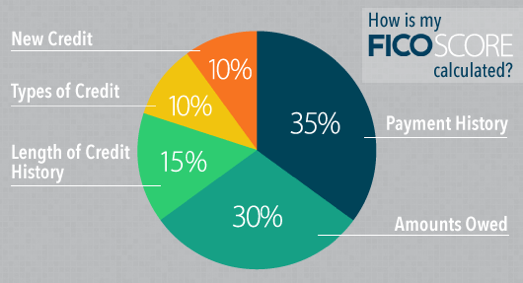

- Know your credit score.

- You can easily see this number at Credit Karma, and the service is free.

- Determine what factors make you less attractive.

- High student loan balances, maxed out credit cards, judgments, liens, unpaid taxes and underreported income can hurt you.

- Analyze your actual credit report and correct errors. The FTC reports that one of every five credit reports contains inaccuracies.

- Optimize your credit status by paying down card balances to below 30 percent; do not make any large credit purchases while attempting to secure home financing.

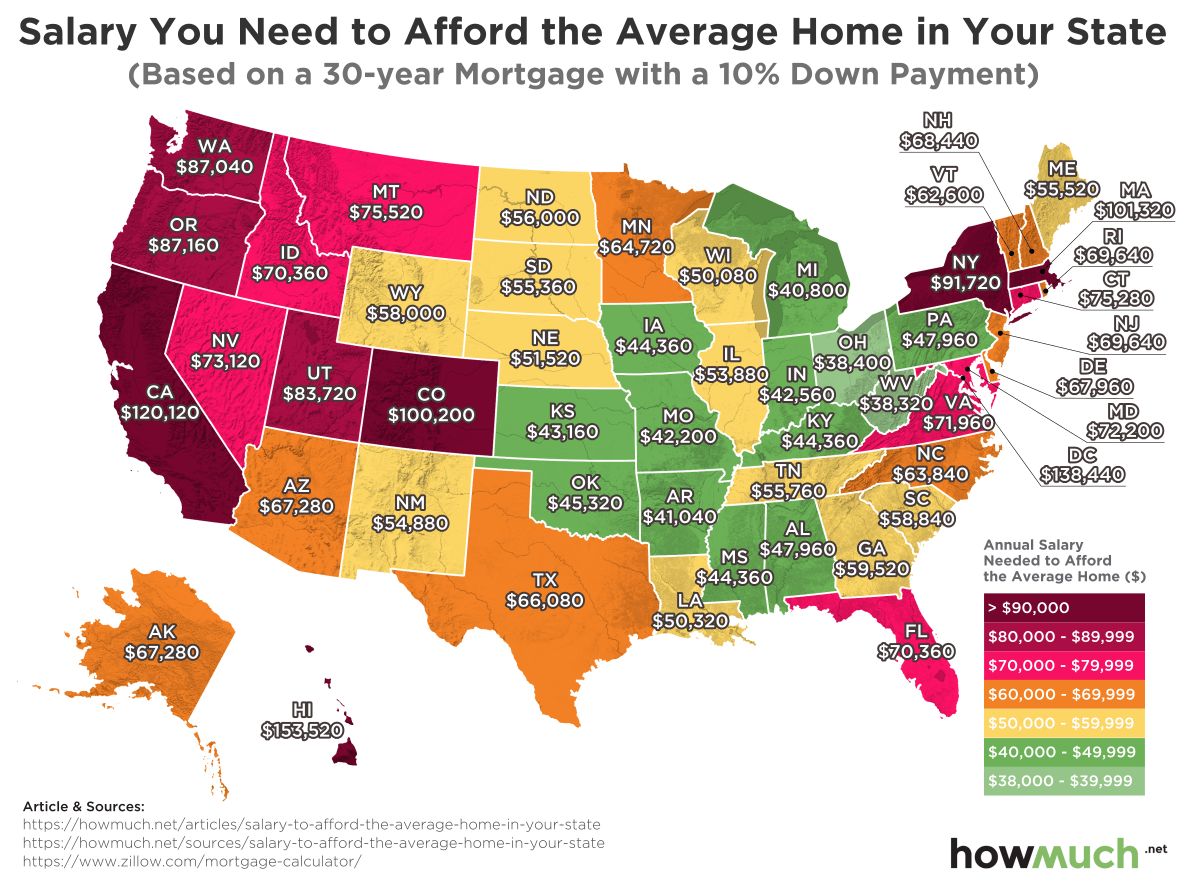

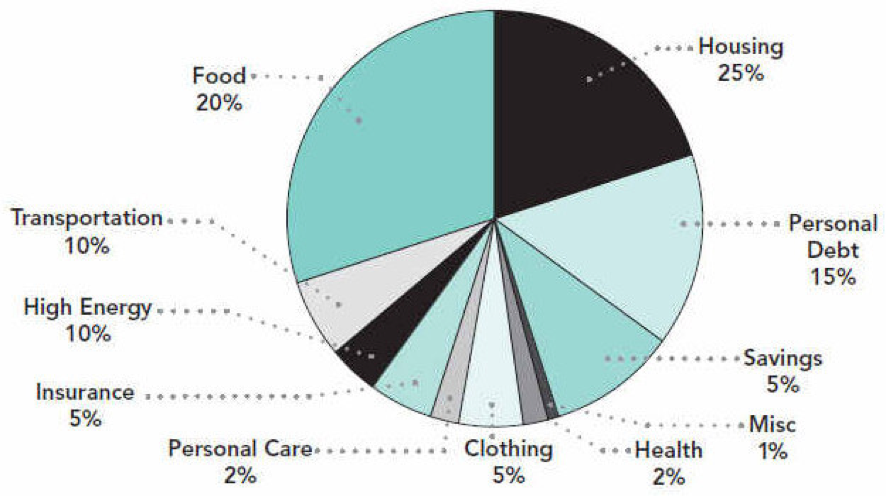

Understanding What You Can Afford

Banks have certain debt to income ratios that they do strictly enforce. The Consumer Financial Protection Bureau (CFPB) explains:

“Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the payments you make every month to repay the money you have borrowed.”

To calculate your debt-to-income ratio, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2000. ($1500 + $100 + $400 = $2,000.) If your gross monthly income is $6000, then your debt-to-income ratio is 33 percent. ($2000 is 33% of $6000.)

Evidence from studies of mortgage loans suggest that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments. The 43 percent debt-to-income ratio is important because, in most cases, that is the highest ratio a borrower can have and still get a qualified mortgage.

Finding Your Home

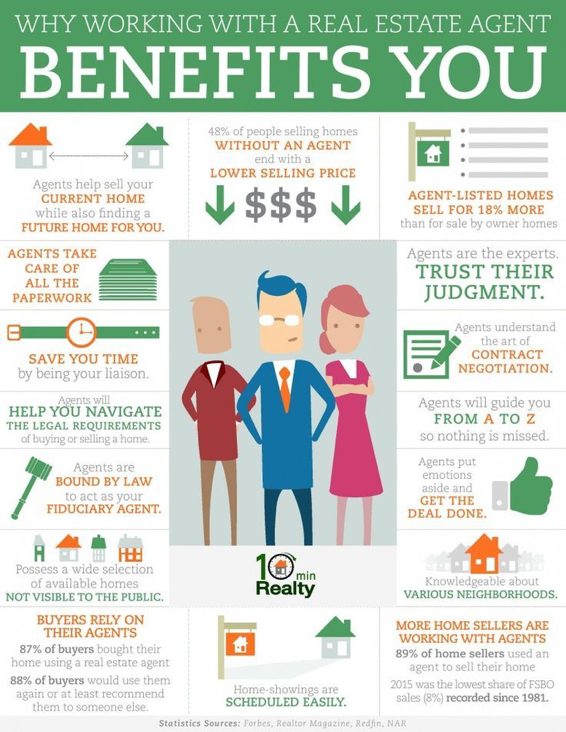

You can spend all day trolling Trulia and Redfin, but many times you can be missing out on homes for sale that only Realtors can easily access. Remember, sellers pay real estate commissions—you don’t—so avail yourself of this free service and find a good Realtor.

Working With A Contract for Deed Realtor

The Realtor/client relationship is a two-way street. If you are a type A personality and want all of your texts answered within two minutes, make sure your Realtor is as hyper as you are. Conversely, don’t expect your Realtor to work miracles with incomplete or false information. For example, don’t inflate your income and/or minimize your debts at your first meeting. In the credit world, there are no secrets, so be upfront with you Realtor.

Turned Down For Traditional Financing?

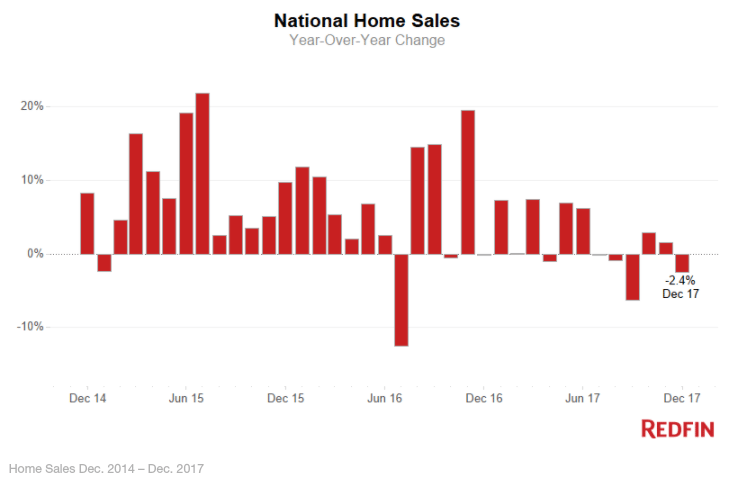

Those that give up after being rejected for a home loan end up renting apartments while those savvy enough to understand that there are alternatives to conventional financing will look at the rejection as a bump in the road and move forward. Rent to own is one way to become a homeowner, but a preferred method is MN contract for deed. In a rent to own situation, you pay rent to a property owner that may put aside a portion of your monthly rent as a down payment for a future purchase.

If everything works out, either the seller provides financing or you obtain it at some later date. In a contract for deed sale, you sign a contract that states that you will be given the deed to the property you are occupying after you make all of your required payments. Contract for deed is seller financing, and while interest rates can be a bit higher than conventional financing, credit requirements are typically significantly more lenient.

Finding Contract For Deed Opportunities

There are a limited number of MLS contract for deed listings. If you’re lucky, you might find the right opportunity in a nice location. At C4D, however, we give you an advantage that others that wish to utilize contract for deed just don’t have. Just bring the home you wish to purchase to us. If we can do the deal, we will purchase the home and sell it to you on a contract for deed basis. We have paved the home ownership road for many that were rejected for conventional financing. Application is easy—just go to our website. C4D has the financial power behind them to make these deals happen.

Contract For Deed Documentation

While C4D offers less stringent credit requirements, we still will need pay stubs and bank statements. We look, however, at your situation today, and we care a lot more about what you can do now than what bad things have happened to you in the past. At C4D even high student loan balances and recent bankruptcies are not necessarily the hindrances they would be at a large bank.

Contract For Deed: How It Works

Although the nightmare of waiting 60 days or more to close on even great credit deals is generally behind us, banks take longer than we do at C4D. We usually can close deals in as fast as two to three weeks.

MN Contract For Deed Costs

We’re upfront about all of this. We do require an origination fee and we do add a small initial property markup. And, the interest rate you pay will be higher than the prevailing conventional mortgage interest rate.

Contract for Deed: What Problems?

We have many satisfied former renters that are now homeowners. We are transparent and forthright. If we can help you, we do everything possible to get your deal done. We are MN contract for deed experts, and happy customers are our paramount concern.

If you deal with an individual that is offering a contract for deed, you have to do serious vetting to ensure that there will be no problems with your deal in the future. With C4D, this is not necessary.

Contract for Deed: True Disclosure

When we purchase your home, we get a loan from our bank. With the blessing and full knowledge of our bank, we then sell the property to you with a MN contract for deed. You make your monthly payments to us and we, in turn, make our payment to the bank. But check this out:

We’ve never missed a payment and don’t ever plan on it. In addition, we’ve worked with our bank partner to have an assignment of contract included in your documents that basically says if we stop paying our lender, you can pay them directly and your contract remains intact.

You won’t find this protection with most individual contract for deed sales. In fact, many times the seller’s bank isn’t even made aware of the transaction, and this can throw the original mortgage into default because of the due on sale clause that is embedded in almost every mortgage note. Our agreements with our bank do not have due on sale clauses.

Everything is upfront and at closing the contract is recorded at the appropriate County.

Helping You Refinance

Our goal is to get you into a home and ultimately help you refinance with a traditional lender. We have relationships and systems in place to help make this happen. Typically, we can help people refinance within three years of purchase.

For the Realtor: Turned Down? There Is Still Hope!

So you spent weeks trying to get your buyer and seller agree upon a price. Both were difficult at times, and when you finally got all sides to listen to reason, an old unpaid judgment appeared and derailed the financing. After you’re done binge watching House of Cards to ease your pain, give us a call. We have been able to resurrect many deals that have been turned down by others.

We are a reputable, experienced and recognized company that does MN contract for deed. You bring us the buyer and the property, we buy the property and sell it to your client on a contract for deed. Even if you have an iffy buyer with shaky credit and you have not yet found the perfect property, bring them to us; we will get many of them pre-approved and send them back to you.

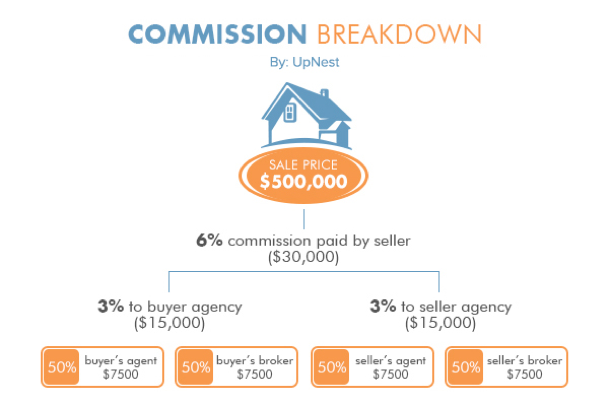

Is My Commission Protected?

You betcha! 80% of our referrals come from realtors, and they wouldn’t keep coming back if we didn’t guarantee that their commissions would be protected.

The Deed

Contract for deed means exactly that.

- We buy the property.

- We hold the deed.

- We sell the property to the buyer.

- They occupy the home.

- They make their monthly payments.

- At the end of the contract period, we turn over the deed and they are homeowners!

- They can also refinance early with a traditional lender, and this is something that we will facilitate.

- In addition, the buyer actually has equitable title, and can sell the property at any time if they wish to move on.

What About Financing?

Yes, we use a bank.

- Our bank gives us a mortgage.

- Our bank knows what we are doing.

- The buyer pays us and we pay the bank.

- We are never late.

- We never miss payments.

- Our mortgage with our bank does NOT include a due on sale clause.

- In fact, we have an assignment of contract put in place that basically says if we stop paying our lender, the buyer can pay them directly and the contract remains intact!

The Final Paperwork

We will hold your client’s hand from application to closing. We will assist with all documentation and paperwork.

When The Offer Is Accepted

At this point, Taylor and the C4D Crew take over. We work directly with the lender and title company to schedule closing and work out all the paperwork. The C4D Crew will also work directly with the C4D buyer on all the paperwork and logistics for the day of closing This will be one of the easier transactions you do this year!

Down-Payment

A down-payment is of course necessary, but the down payment be gifted to the buyer in a C4D transaction. Just make sure your clients speak with their accountant for possible tax implications.

C4D Crew Reputation

We can provide you with client references. Just by looking at our website you can see that we provide tons of valuable and free information about MN contract for deed. Of course, we are in business to make money—so are you—but we are also dedicated to helping those with compromised credit become homeowners.

How Long Does It Take?

From the time you and your client find a home they’d like to buy, and an offer is accepted, we can close as quickly as two to three weeks.

Credit Score Minimum?

We don’t have one. We look at every deal individually. Prior BKs, student loans, judgments divorces and tax liens are all issues we can work around.

Can You Approve Any Deal?

In short, no. We are not going to lie and tell you that we can do anything, but you would be amazed at what we can accomplish.

Call Us About Contract For Deed

Again, just because the loan officer rejected your client’s loan, your deal is not necessarily dead. Contact us and we’ll quickly get started on a contract for deed program that can make your client’s home ownership dream a reality.

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without