Buying A House Without A Realtor: Terrible Idea?

https://www.c4dcrew.com/wp-content/uploads/2018/05/CONTRACT-FOR-DEED_-PROS-AND-CONS-20.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/0cd60208d9de9b4ec7236a52868375f0187854b5ee1fefa7603d0294819d3045?s=96&d=mm&r=gBuying a house without a realtor. For some reason, this just doesn’t sound like one of your best ideas yet.

You may be the kind of person that wants to handle everything without assistance from brokers or agents. When you make a major purchase you always want to talk to the supervisor or store owner, and you may not like dealing with middlemen. When you are looking to buy a MN home, however, you really need to consider the use of a qualified Realtor, and here are some reasons why:

You May Have a Harder Time Finding Properties

Realtors have MLS access but you can’t just login online to view it. While Trulia, Redfin, and similar sites will eventually pick up MLS listings, there is nothing like going to the source and being able to view up-to-the-minute listed properties that are for sale. Your local real estate agent may also have a network where he or she is made quickly aware of any “coming soon” properties, and your Realtor can find out sooner if a house under contract may again become available because of failed financing or other issues. In addition, other Realtors may be more apt to divulge information to another Realtor than to you.

Area Knowledge

Especially if you are new to a city, you need a Realtor’s intrinsic neighborhood knowledge. Many of us know someone that recently moved to a city and chose a certain neighborhood only to realize a year later that they would have liked to have located in a different part of town. A good Realtor can help guide you to the neighborhoods that match your lifestyle.

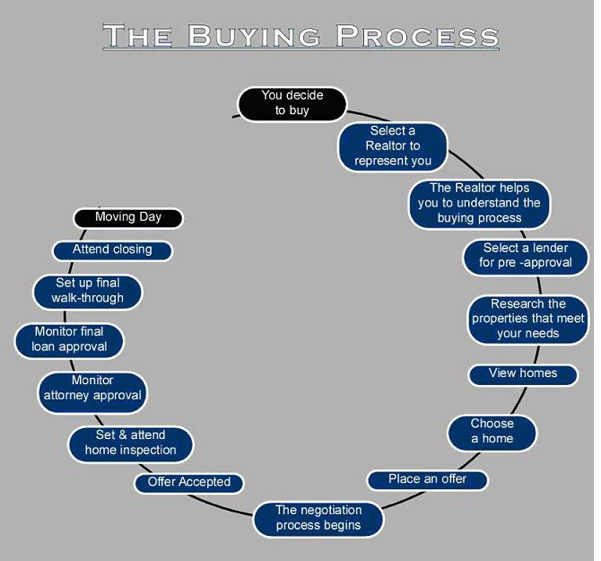

The Offer (When Buying A House Without A Realtor)

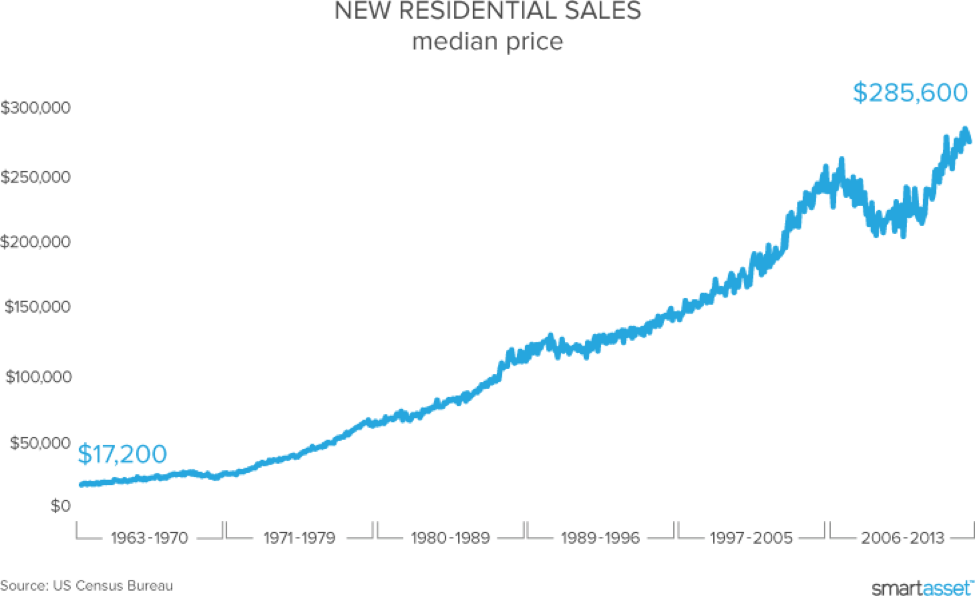

Do you offer 97 percent of the purchase price? 95 percent? Are you in a bidding war? Should you offer more than the asking price? Should you ask for paid closing costs? What does the inspection period mean? Do you realize, that in some states, you can lose your earnest money deposit even if your financing is not approved? Realtors are experts, and will guide you through the offer process. Take a look a standard offer to purchase form, and ask yourself if you really know how to fill in all of the blanks properly. A Realtor will have had lots of experience with contingencies, and will help you understand all fees involved in a purchase contract.

Be Realistic About the Deal

While you may think it’s a good idea to haggle about the final $1000 of a $350,000 deal, your Realtor may tell you otherwise. Realtors have a good sense of what will be accepted and more, importantly, what may aggravate a seller. When you deal with sellers without a Realtor, you may be working blind.

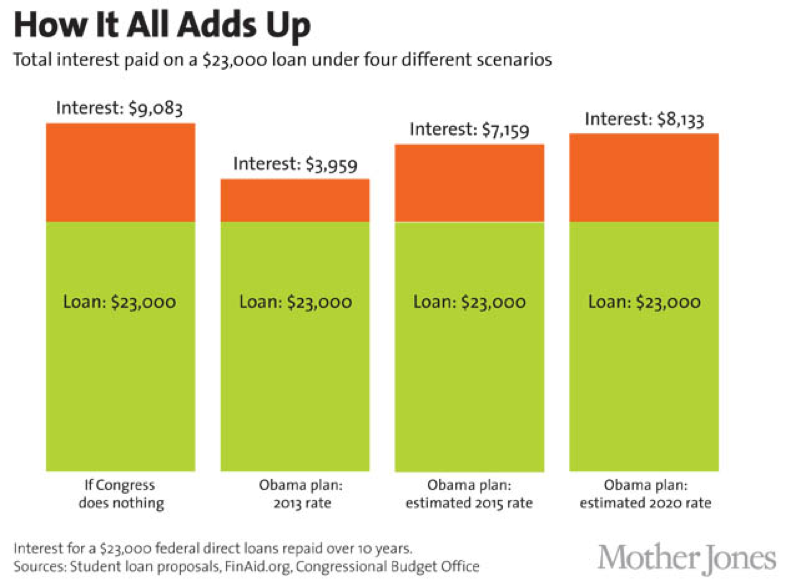

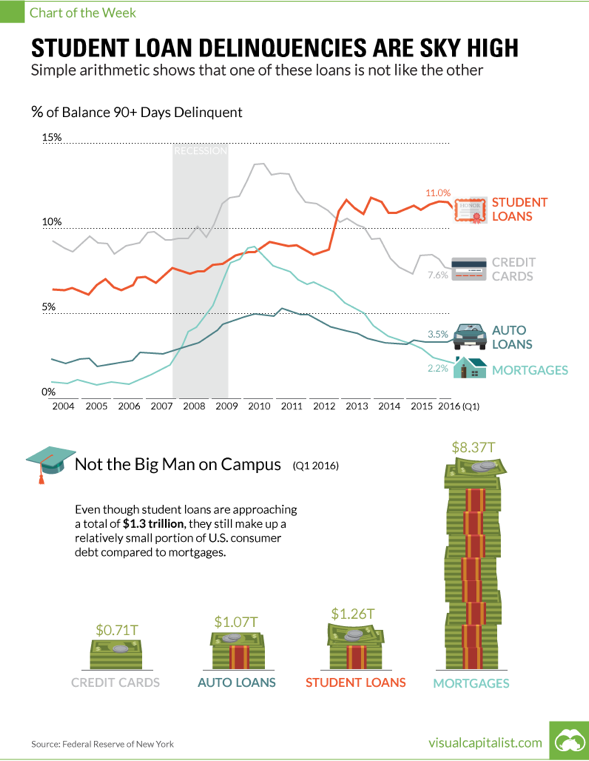

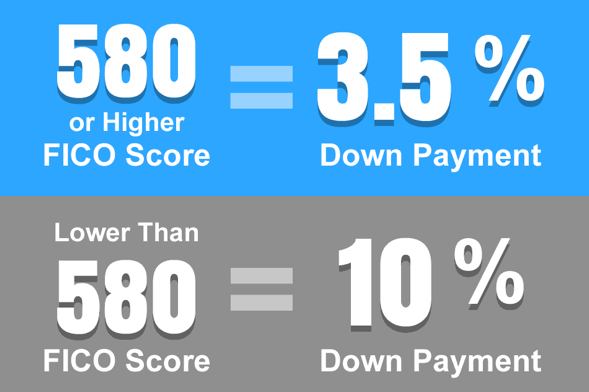

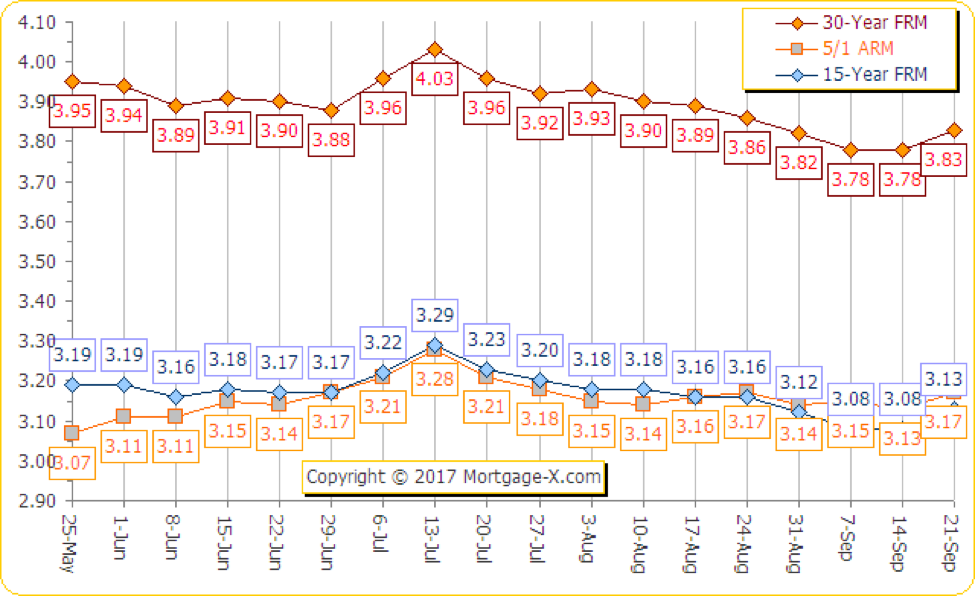

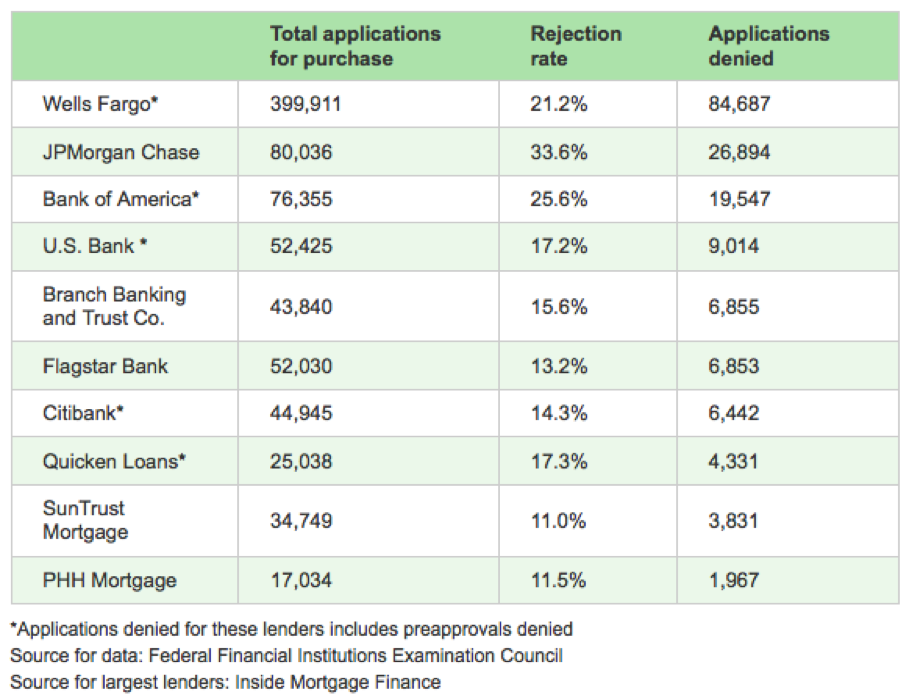

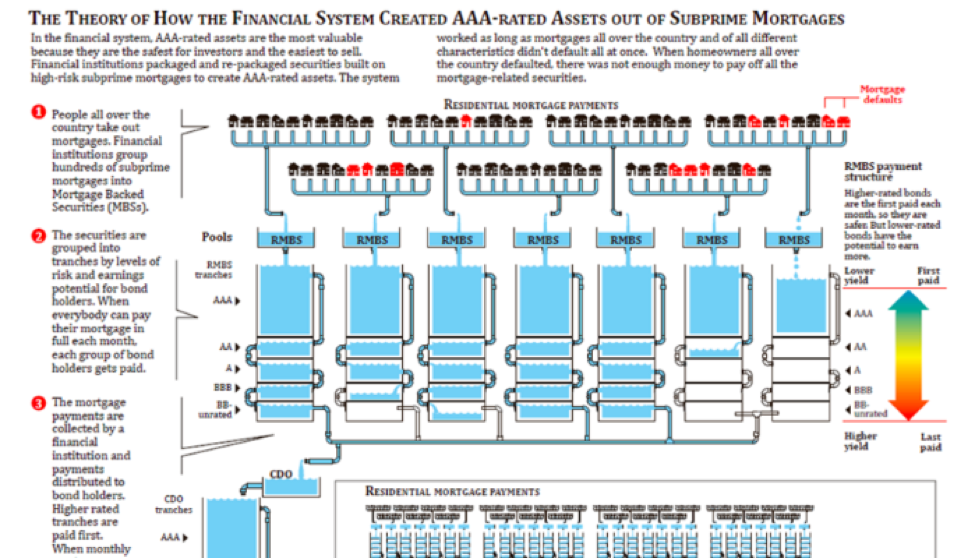

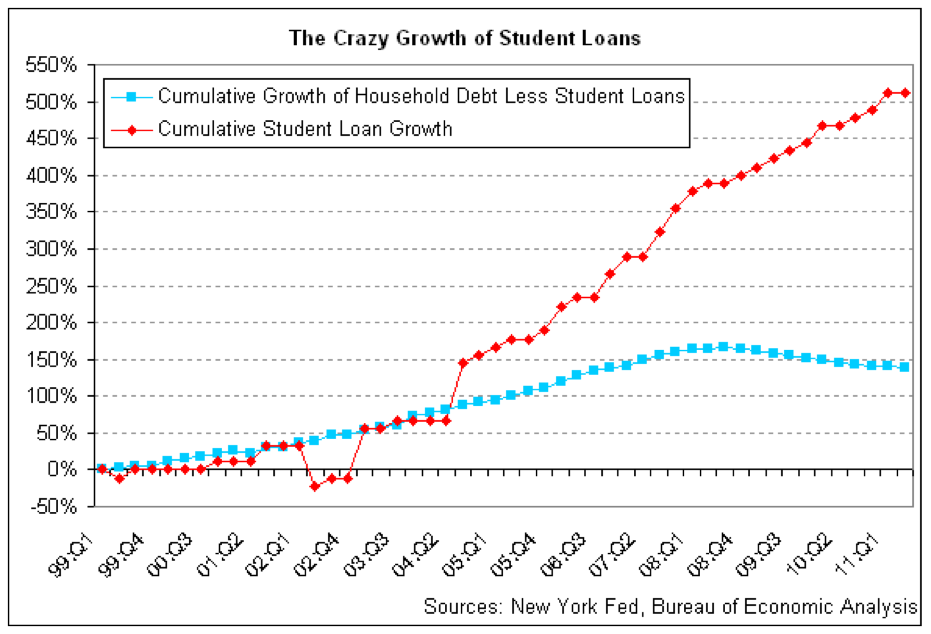

Financing Issues When Buying Without A Realtor

If you have MN bad credit, or are having trouble buying a home because of massive student loan debt, a good Realtor can steer you to non-traditional financing sources. We at C4D are experts in MN contract for deed sales, and many Realtors come to us with deals that have been difficult to finance elsewhere. While we all know that traditional mortgage financing is preferable, many times we can help get you into your dream home when others have not been successful.