First Time Home Buyer Checklist: 15 Quick Tips

https://www.c4dcrew.com/wp-content/uploads/2018/09/CONTRACT-FOR-DEED_-PROS-AND-CONS-12.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gYou’re going to get a lot of advice thrown at you as you attempt to purchase your fist home. Financing, inspections, Realtors, credit scores and many more similar issues will need to be dealt with. First, however, check out the following 15 tips on our first time home buyer checklist:

First Time Home Buyer Checklist

1) Is Real Estate Recession Proof?

No, it’s not. If you buy at the top of the market, realize that you may not be able to turn around a year later and make a profit or even get your money out if the economy has tanked. Sure, if you wait long enough things might turn around, but if you need your money quickly in a bad economy, realize that a reasonable sale might take quite a while to consummate.

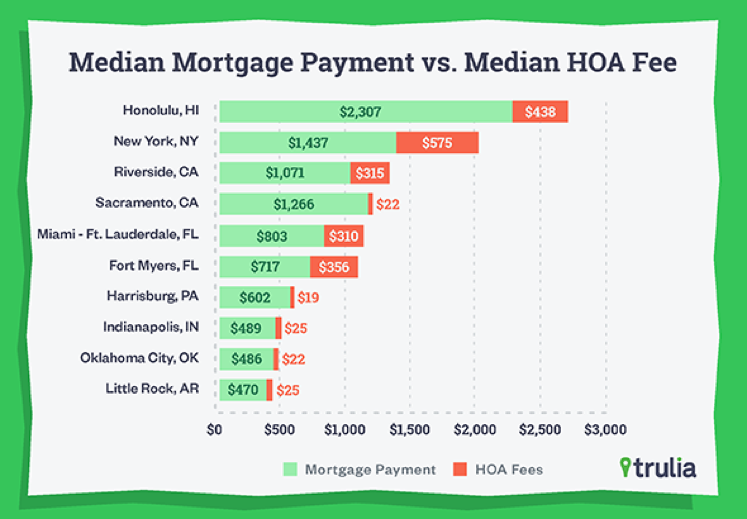

2) HOA

Thought HOAs were just for those that bought condos? Think again, as buying into a deed restricted community governed by an HOA may mean that you can’t paint your house purple—even if you own it outright. This is an important piece of the first time home buyer checklist. Don’t forget about extra fees!

3) I Qualified for a $450,000 loan

That’s great, but it doesn’t mean that you have to stretch your budget and buy a $450,000 home. Buy only what you can afford, and don’t pay attention to any higher amount that you have qualified for.

4) Good Money

First time home buyer checklist number four — beware of exotic low-interest, no-interest or no down-payment loans as these can be costly in the future.

5) Check Those Renovations

You may be a woodworking DIY person, but you certainly don’t want to inherit the first-time renovations from the previous accountant owner that couldn’t figure out how to use a reciprocating saw.

6) Location

Pick your location first, and then your home. A perfect home in a bad location really isn’t a perfect home.

7) DIY

If the home your want does need repairs and you are handy, DIY in this case may be a good option. Just make sure you know what you are doing. And of course, a fixer-upper can be purchased at a better price.

8) School District

Unless you are considering private schools, make sure you properly vet the neighborhood schools before you make any offers. Consider using a tool like Niche to find the best schools in your neighborhood or city.

9) Survey

Tell your Realtor you want a current property survey. This will accurately map the borders of your property and help avoid disputes later.

10) Good Inspection

Don’t look at the inspection as possible impediment to closing. A good inspector may find enough things wrong so that you will want to walk away from the deal.

11) Negotiate

Negotiate like you don’t care if you get the house or not. Sure, this is easier said than done, but great negotiators always operate this way.

12) Yard

If the yard is really ugly and you don’t want to rejuvenate it yourself, consider asking the seller to provide a landscaping credit.

13) Low-balling

Don’t look at every home as an opportunity to offer $50,000 less than the asking price. First the sellers—and then your Realtor—will not take you seriously after you establish a pattern of this behavior.

14) Building Plans

Go to the city hall and check upcoming building plans. That way you won’t be surprised when that great park-like open field a block away becomes a 300-unit apartment complex.

15) Extra Cash

Don’t walk away from your closing with the key and no cash left because unforeseen expenses can be counted upon. If we all could make free money, this wouldn’t be an issue, but you need to be careful.

Remember, your first home is a big deal, and we hope our first time home buyer checklist has brought some important points to your attention. And if you are turned down by the bank, don’t give up. Contact us and we will let you know how we can help.