Minneapolis Real Estate Market: Where We Stand

https://www.c4dcrew.com/wp-content/uploads/2018/06/CONTRACT-FOR-DEED_-PROS-AND-CONS-26.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gWe’d like to get technical this week about the Minneapolis real estate market and summarize the comprehensive and extensive report from the Minneapolis Area Association of Realtors.

While of course what’s happening in the Minneapolis real estate market doesn’t exactly mirror the entire State of Minnesota, it does give us a clear picture of what is going on in our region.

Interest Rates

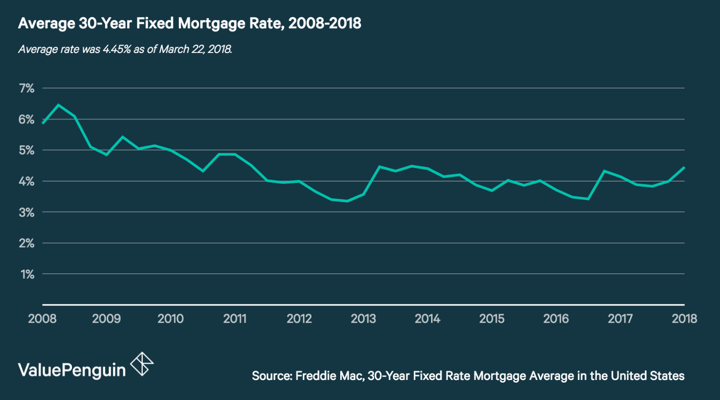

The Federal Reserve moved again, and raised interest rates for the seventh time since 2015. This second 2018 rate hike raised rates by another 0.25 percent. While this didn’t immediately increase the 30-year mortgage rate, rates will inevitably rise.

New Twin Cities Listings

- New listings decreased 2.7 percent to around 2000.

- Pending listings also decreased 4.1 percent to around 1400.

- Inventory decreased significantly by over 18 percent.

What Happened in May?

May was a strong sales month for the Minneapolis real estate market, however, as the median home sales price increased 8.4 percent to $271,000, while days on market decreased 9.6 percent to only 47. The all-important supply figure—in other words how much inventory is available—fell a whopping 12 percent to 2.2 months.

Minneapolis Real Estate Market Trends

So what do these trends mean for the MN Realtor? First, interest rates are on their way up. Mortgage guru Rachel Witkowski recently said:

“Here are several predictions from the largest housing and mortgage groups for the 30-year fixed-rate mortgage:

- The Mortgage Bankers Association predicts it will rise to 4.6 percent in 2018.

- The National Association of Realtors expects it be around 4.5 percent at the end of 2018.

- Realtor.com says the rate will average 4.6 percent and reach 5 percent by year-end.”

When rates near the five percent mark, two things can happen. Buyers can become nervous and there can be increased activity as they worry that their buying power may soon be diminished, but after a sales flurry, home prices can begin to decrease because that ethereal buying power actually will dwindle, and this will result in less demand.

Ride the Minneapolis Real Estate Market Wave

As a savvy Minneapolis Realtor, you can use these trends to your advantage as you can nudge buyers into making offers now before higher rates injure them, while at the same time you can counsel sellers to take offers quickly as their homes could be less valuable in the near future.

When It Does Happen

If you’ve been in business for a while, you know that tough real estate market conditions will reoccur. Whether this happens late this year or early next year, higher interest rates = lower stock prices = a weaker economy, and that all can pressure home prices. If a recession does occur, monetary policy will undoubtedly tighten, foreclosures will increase, and financing in general will become more difficult.

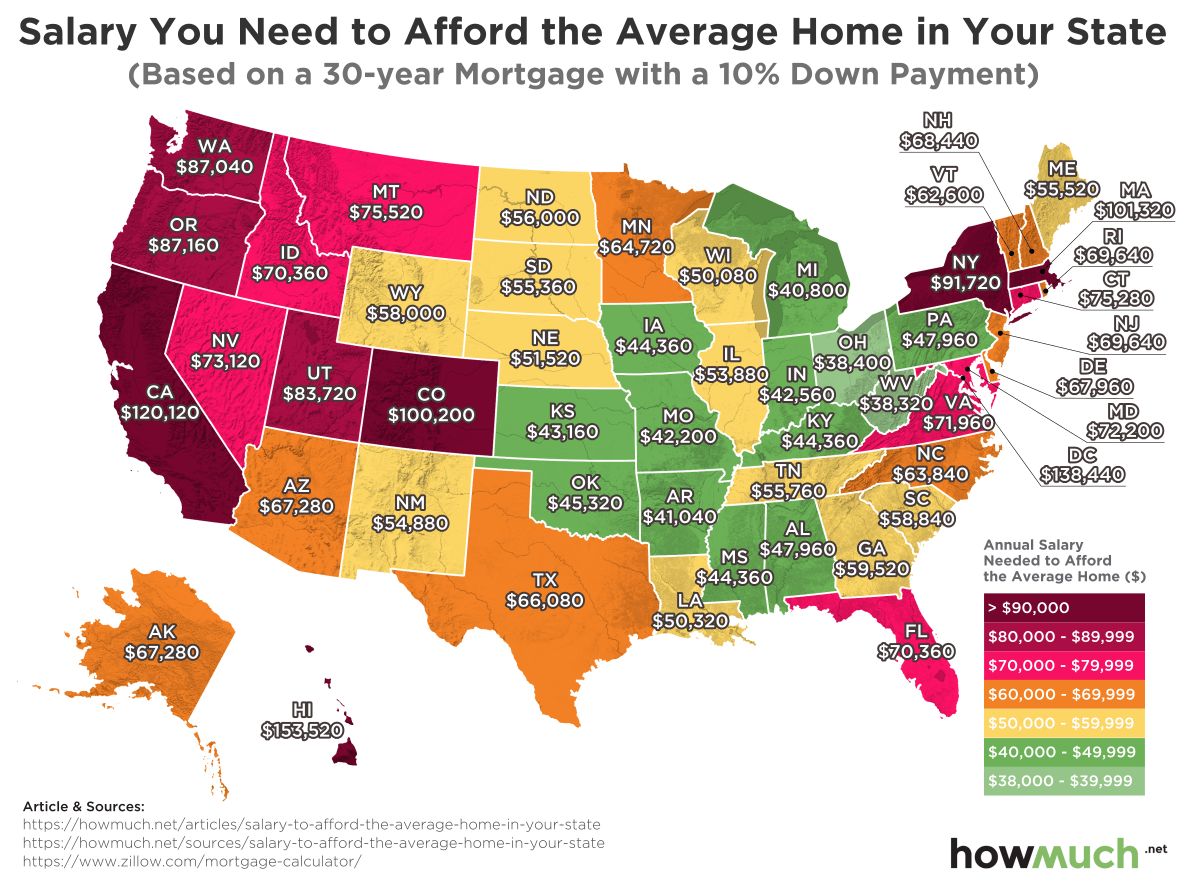

And you also know that your clients are going to start looking at charts like the one below from howmuch.net. They’ll want to know what they can actually afford. So, be prepared to guide them into making smart decisions.

Remember Us

This is when you need to realize that we at C4D can make deals happen when others cannot. As your MN contract for deed experts, we strive to find ways to take your marginal deals and get them approved. We have taken many hard working but credit score challenged individuals from renters to owners. Please contact us and see what we can do after the bank has said no. You may be pleasantly surprised!